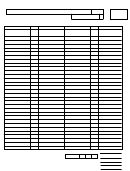

Form E-588a - Incentive Claim For Refund For Aviation Fuel For Motorsports State, County, And Transit Sales And Use Taxes Page 2

ADVERTISEMENT

10

11

12

13

Page 2

Office

E588A

Name of

County Tax

Ratio of

Refund Due

Web

Taxing County

Paid on All Purchases

Miles

Use Only

Each County

7-13

.

,

.

,

.

,

.

.

,

.

,

.

.

,

.

.

,

.

,

.

.

.

.

,

,

,

.

.

,

.

.

,

.

,

.

,

.

.

,

.

,

,

.

.

.

,

,

.

.

.

,

.

.

,

.

,

,

.

,

,

.

Totals:

0.50% Tax

Ratio

0.50% Refund Due

,

,

.

.

.

0 3 2

Durham Transit 0.50% Tax

,

,

.

.

.

0 6 0

Mecklenburg Transit 0.50% Tax

,

0 6 8

,

.

.

.

Orange Transit 0.50% Tax

,

,

,

.

,

.

Totals for Transit

Use blue or black ink to complete this form.

Column 10 -

Enter the name of each taxing county for which a refund is due. If more space is needed, attach an additional sheet.

Column 11 -

Enter the total amounts of 2.00% and 2.25% county sales and use tax paid on purchases of aviation fuel attributable to the county listed in Column

10. The column total must equal the amounts of 2.00% and 2.25% county tax paid on purchases as reflected on Line 7.

Enter the ratio of miles for qualifying purposes as derived on Line 3. Carry decimal amount to four places (Ex: .7546).

Column 12 -

Column 13 -

Multiply the county tax in Column 11 by the ratio in Column 12 and enter the total refund due for each county at both the 2.00% and 2.25%

county tax rates. The column total must equal the total amounts of County 2.00% and 2.25% tax refund as reflected on Line 8.

If applicable, complete the entries for the Transit 0.50% Tax.

Instructions

G.S. 105-164.14A(a)(4) provides that a professional motorsports racing team, a motorsports sanctioning body, or a related member of such team or body

is allowed a refund of sales and use tax paid by it in North Carolina on aviation fuel used to travel to or from a motorsports event in this State, to travel to

a motorsports event in another state from a North Carolina location, or that is to travel to North Carolina from a motorsports event in another state. For

purposes of the refund provision, a “motorsports event” includes a motorsports race, a motorsports sponsor event, and motorsports testing. For purposes

of this refund, a related member is defined in G.S. 105-164.3(33b).

Claims for refund are due by December 31 for the prior fiscal year ending June 30; a refund applied for after the due date is barred. The refund provision

is repealed effective for purchases made on or after January 1, 2016.

The Department will take one of the following actions within six months after the date the claim is filed: (1) Send the requested refund to you; (2) Adjust the

amount of the refund; (3) Deny the refund; or (4) Request additional information.

If the Department does not take one of the actions within six months, the inaction is considered a proposed denial of the requested refund. If you object to

a proposed denial of a refund, you may request a Departmental review of the action provided the request is made in writing and filed within 45 days of the

date the notice of proposed denial was mailed to you. If the Department has not taken action within six months after the date the claim was filed, a request

for review can be filed at any time between the end of the six-month period and when the Department takes a prescribed action. If a timely request for a

Departmental review is not filed, the proposed action is final and is not subject to further administrative or judicial review.

If you have questions about how to complete this form, you may call the Taxpayer Assistance and Collection Center toll-free at 1-877-252-3052.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2