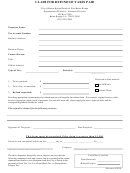

Form Ft-504 - Claim For Refund Of Taxes Paid On Fuel By A Government Entity Page 4

ADVERTISEMENT

Page 4 of 4 FT‑504 (9/11)

Instructions

Who may use this form

Paid preparer identification numbers

Any government entity who purchases motor fuel or diesel motor fuel

New York State Tax Law requires certain paid tax return preparers

on which the motor fuel or diesel motor fuel excise tax, the petroleum

and facilitators of refund anticipation loans (RALs) and refund

business tax, and New York State (NYS) and local sales taxes have

anticipation checks (RACs) to register electronically with the Tax

been passed through, and who uses the motor fuel for its own use

Department. When completing this section, you must enter your

and consumption, may use this form to claim a refund of the above

New York tax preparer registration identification number (NYTPRIN)

taxes. This generally does not include fuel used or consumed by a

if you are required to have one. (Information on the New York State

contractor. See Publication 765, Sales and Fuel Excise Tax Information

Tax Preparer Registration Program is available at our Web site; see

for Properly Appointed Agents of New York Governmental Entities,

Need help?.) In addition, you must enter your federal preparer tax

for more information.

identification number (PTIN) if you have one; if not, you must enter

your social security number (SSN). (PTIN information is available at

The term government entity means:

)

• NYS, or any of its agencies, instrumentalities, public

corporations (including a public corporation created pursuant to

Where to file

agreement or compact with another state or Canada) or political

The completed refund application and required documentation

subdivisions;

should be mailed to:

NYS TAX DEPARTMENT

• The United States of America and any of its agencies and

FUEL TAX REFUND UNIT

instrumentalities;

PO BOX 5501

ALBANY NY 12205‑0501

• The United Nations or any international organization of which the

United States is a member; or

Private delivery services — If you choose, you may use a private

• Any diplomatic mission or diplomatic personnel who are

delivery service, instead of the U.S. Postal Service, to mail in your

permitted to purchase motor fuel and diesel motor fuel exempt

form and tax payment. However, if, at a later date, you need to

from sales tax.

establish the date you filed or paid your tax, you cannot use the

date recorded by a private delivery service unless you used a

When to file

delivery service that has been designated by the U.S. Secretary

A claim for refund should be filed for a full monthly period;

of the Treasury or the Commissioner of Taxation and Finance.

however, a claimant may include more than one month in a single

(Currently designated delivery services are listed in Publication 55,

claim. Each monthly period should begin on the first and end on

Designated Private Delivery Services. See Need help? for

the last day of a calendar month.

information on obtaining forms and publications.) If you have used

a designated private delivery service and need to establish the

Claims for refund of the motor fuel or diesel motor fuel excise tax

date you filed your form, contact that private delivery service for

and the petroleum business tax must be filed within three years

instructions on how to obtain written proof of the date your form

from the date of purchase. Claims for refund of the NYS and local

was given to the delivery service for delivery. If you use any private

sales tax should be filed within three years from the date the tax

delivery service, whether it is a designated service or not, send the

was payable to the Commissioner of Taxation and Finance.

form to the appropriate address listed on Publication 55.

General instructions

Need help?

To expedite the processing of a refund claim, a claimant must

furnish the necessary substantiation and adhere to the following

Visit our Web site at

procedures:

• get information and manage your taxes online

• You must complete the entire claim form, including schedules

• check for new online services and features

A and B. Attach a worksheet, if necessary, and include adding

Telephone assistance

machine tapes if the worksheet is not computer‑generated.

• You must furnish legible copies of monthly statements or

Miscellaneous Tax Information Center:

(518) 457‑5735

purchase invoices showing each tax (motor fuel and/or diesel

motor fuel excise tax, petroleum business tax, and sales tax)

To order forms and publications:

(518) 457‑5431

listed separately.

Text Telephone (TTY) Hotline (for persons with

• You must include your telephone number in case we need to

hearing and speech disabilities using a TTY):

(518) 485‑5082

contact you concerning your refund.

Persons with disabilities: In compliance with the

Additional documentation may be requested by the Tax

Americans with Disabilities Act, we will ensure that our

Department upon review of the refund claim submitted.

lobbies, offices, meeting rooms, and other facilities are

Line instructions

accessible to persons with disabilities. If you have questions

about special accommodations for persons with disabilities,

Lines 1 and 2 — Enter the number of gallons and applicable

call the information center.

excise tax paid from schedules A and B.

Lines 4 and 5 — Enter the number of gallons and applicable

Privacy notification — The Commissioner of Taxation and Finance may collect and maintain

petroleum business tax paid from schedules A and B.

personal information pursuant to the New York State Tax Law, including but not limited to,

sections 5‑a, 171, 171‑a, 287, 308, 429, 475, 505, 697, 1096, 1142, and 1415 of that Law; and may

Lines 7 and 8 — Enter the number of gallons and applicable state

require disclosure of social security numbers pursuant to 42 USC 405(c)(2)(C)(i).

and local sales tax paid from schedules A and B.

This information will be used to determine and administer tax liabilities and, when authorized by

law, for certain tax offset and exchange of tax information programs as well as for any other lawful

Schedules A and B

purpose.

Information concerning quarterly wages paid to employees is provided to certain state agencies

Complete all columns of schedules A and B. Enter information for

for purposes of fraud prevention, support enforcement, evaluation of the effectiveness of certain

those purchases for which a refund is claimed. Attach copies of

employment and training programs and other purposes authorized by law.

all invoices listed. Attach additional sheets if necessary. Be sure to

Failure to provide the required information may subject you to civil or criminal penalties, or both,

under the Tax Law.

total the Number of gallons, Excise tax paid, Petroleum business

This information is maintained by the Manager of Document Management, NYS Tax Department,

tax paid, and Sales tax paid columns. The totals of these columns

W A Harriman Campus, Albany NY 12227; telephone (518) 457‑5181.

must be carried to the front page as indicated.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4