Form Ft-943 - Quarterly Inventory Report By Retail Service Stations And Fixed Base Operators Page 2

ADVERTISEMENT

Page 2 of 2 FT-943 (11/15)

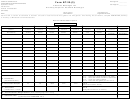

Part 3 – Summary of motor fuel and diesel motor fuel purchases

Retail vendors must report motor fuel purchases (if not registered as a

For diesel motor fuel purchases – Enter the name and identification

motor fuel distributor) and highway diesel motor fuel purchases (if not

number of the supplier from whom the fuel was purchased as it appears on

registered as a diesel motor fuel or kero-jet fuel distributor). Complete

either Form FT-1000, Certificate of Prepayment or Payment of Taxes on

columns A through D for appropriate fuels purchased this quarter.

Diesel Motor Fuel, or on another document given to you certifying that the

taxes were paid. List all suppliers from whom you purchase diesel motor

fuel.

Column A

For motor fuel purchases – Enter the name and identification number

Column B – Enter the address (street, city, state, and ZIP code) of each

of the supplier from whom the fuel was purchased as it appears on either

supplier listed in column A.

Form FT-935, Certification of Taxes Paid on Motor Fuel (Prepayment of

Column C – Indicate the type of fuel purchased by entering U (regular

Sales Tax and Payment of the Motor Fuel Tax and the Petroleum Business

unleaded), M (mid-grade unleaded), P (premium unleaded), D (diesel), or

Tax), or on another document given to you certifying that the taxes were

K (kero-jet).

paid. List all suppliers from whom you purchase motor fuel.

Column D – Enter the total number of gallons for each type of fuel

If you are a wholesaler, jobber, etc., and reported a transfer of motor fuel

purchased during the quarter from that supplier.

from your non-retail marketing locations to your retail service station in

Part 3 of Form FT-945/1045, Sales Tax Prepayment on Motor Fuel/Diesel

Enter the information requested in columns A through D for those purchases

Motor Fuel Return, enter self in column A and complete the information

of petroleum products made in New York State.

requested in columns C and D for that fuel.

A – Name and ID number of supplier

B – Address of supplier

C – Type

D – Total gallons

of fuel

purchased

(Name)

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

(ID number)

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Attach additional sheets, if necessary, to report all suppliers for the reporting period.

Number of locations – Indicate the number of locations in New York State at which you make retail sales of motor fuel or highway diesel motor

fuel and that are covered by this report.

Signature of authorized person

Official title

Authorized

E-mail address of authorized person

Telephone number

Date

person

(

)

Firm’s name

Firm’s EIN

Preparer’s PTIN or SSN

(or yours if self-employed)

Paid

preparer

Signature of individual preparing this return

Address

City

State

ZIP code

use

only

E-mail address of individual preparing this return

Telephone number

Preparer’s NYTPRIN

NYTPRIN

Date

(see instr.)

excl. code

(

)

Where to file

Signature

If you are a sole proprietor, you must sign the report and print your title,

Mail your report to: NYS Tax Department, Petroleum Tracking Unit,

telephone number, and date.

PO Box 5500, Albany NY 12205-0500.

If you are filing this report for a corporation, partnership, or other type of

Private delivery service – If you are using a private delivery service, see

entity, an officer, employee, or partner must sign the report on behalf of the

Publication 55, Designated Private Delivery Services.

business, and print his or her title, telephone number, and date.

If you do not prepare the report yourself, sign, date, and provide the

Need help?

requested taxpayer information. The preparer must also print his, her,

or the firm’s name, sign the report, and provide the requested preparer

Visit our Web site at

information. Also see Paid preparer’s responsibilities below.

(for information, forms, and online services)

Paid preparer’s responsibilities – Under the law, all paid preparers must

sign and complete the paid preparer section of the form. Paid preparers

Miscellaneous Tax Information Center:

(518) 457-5735

may be subject to civil and/or criminal sanctions if they fail to complete this

section in full.

To order forms and publications:

(518) 457-5431

When completing this section, enter your New York tax preparer registration

Text Telephone (TTY) Hotline

identification number (NYTPRIN) if you are required to have one. If you are not

(for persons with hearing and

required to have a NYTPRIN, enter in the NYTPRIN excl. code box one of the

speech disabilities using a TTY):

(518) 485-5082

specified 2-digit codes listed below that indicates why you are exempt from the

registration requirement. You must enter a NYTPRIN or an exclusion code.

Also, you must enter your federal preparer tax identification number (PTIN) if

Privacy notification – New York State Law requires all government

you have one; if not, you must enter your social security number.

agencies that maintain a system of records to provide notification of the

legal authority for any request, the principal purpose(s) for which the

Code Exemption type

Code Exemption type

information is to be collected, and where it will be maintained. To view this

01

Attorney

02

Employee of attorney

information, visit our Web site, or, if you do not have Internet access, call

and request Publication 54, Privacy Notification. See Need help? for the

03

CPA

04

Employee of CPA

Web address and telephone number.

05

PA (Public Accountant)

06

Employee of PA

07

Enrolled agent

08

Employee of enrolled agent

09

Volunteer tax preparer

10

Employee of business

preparing that business’ return

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2