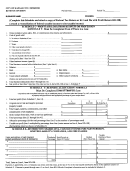

PA Schedule C

Profit or Loss from Business or

Profession (Sole Proprietorship)

PA-40 C (08-14) (FI)

PA DEPARTMENT OF REVENUE

NEW THIS YEAR

Important Differences between Federal and

Pennsylvania Rules

As a result of Act 52 of 2013, up to one-third of the amount of

You may use any accounting method for PA purposes, as long

Intangible Drilling & Development Costs (IDCs) incurred in tax

as you apply your accounting methods consistently. PA law does

years beginning after December 31, 2013 may be directly

not have material participation rules. Report all transactions

expensed with the remaining amount amortized over ten

that are directly related to your business or profession on your

years. Taxpayers may also elect to amortize the full amount

PA Schedule C.

of the IDCs over 10 years. The election to expense any IDCs

is made by including an amount on Line 34 of PA Schedule C.

If you own or operate more than one business, you must

Amortization of the IDCs must be reported separately on Line

submit a separate PA Schedule C for each business operation.

35 of PA Schedule C.

The following federal schedules and instructions do not apply

Act 52 now permits the direct expensing of up to $5,000 of

for PA Schedule C:

business start-up costs. The department follows IRC Section

Schedule A.

You may not deduct nonbusiness-related personal

195(b)(1)(A). The direct expensing of any business start-up

interest, taxes and casualty losses on any PA PIT return.

costs will be reported on Line 36 of PA Schedule C.

Any

Schedule E.

Report rental and royalty income on PA Schedule E,

amount over $5,000 must be amortized over 180 months.

unless engaged in the business of making your property or rights

Amortization of start-up costs will be included with other

available in a public market place with intention to realize a

amortization on Line 7 of PA Schedule C.

profit.

Overview

Schedule F.

Report farming activity on PA Schedule F.

Use PA Schedule C to report income or loss from a business

you operate or a profession you practice as a sole proprietor.

Schedule SE.

Do not report self-employment taxes to

Your activity qualifies as a business if your primary purpose for

Pennsylvania.

engaging in the activity is income or profit, you conduct your

Form 4562.

If using bonus depreciation, do not use Form 4562.

activity with continuity and regularity and you satisfy the

Use Schedule C-2 on Side 2 of this schedule. The maximum

“Commercial Enterprise” test. Certain rental activity may be

deduction PA income tax law permits under IRC Section 179

business income and not rental income. If you are a sole

is $25,000. If you have income or loss from more than one

member of an LLC, complete PA Schedule C.

business, profession or farm, you may not deduct more than

For additional information regarding the definition of a busi-

$25,000 for all business activities.

ness or profession, and for Pennsylvania’s requirements for

Form 4684.

Report gain or (loss) from all business activity on

reporting income and expenses, go to the department's web-

PA Schedule C. Include a casualty or theft loss of business

site at and link to the PA PIT Guide.

property (or gain, if insurance proceeds exceed the basis of

If your business had expenses of $5,000 or less, you may be

the property lost or taken) on Line 4 of PA Schedule C. You

able to use PA Schedule C-EZ instead of PA Schedule C.

may refer to the federal schedule for an explanation of gain or

(loss) items, but do not submit the federal schedule.

Note: Pennsylvania determines income and (loss) under gen-

erally accepted accounting principles, systems or practices that

Form 4797.

Report other sales, exchanges and involuntary

are acceptable by standards of the accounting profession and

conversions of business property on Line 4 of PA Schedule C if

consistent with regulations of the department.

the property sold was replaced. Refer to the federal schedule

for an explanation of gain/loss items, but do not submit the

Pennsylvania allows a taxpayer to use federal tax accounting

federal schedule.

rules to determine income or (loss) to the extent consistent

with department regulations and to the extent federal tax

Form 8271.

Do not report or deduct any transactions related

accounting rules clearly reflect income.

to tax shelters.

•

You may use any accounting method for PA purposes, as

Form 8594.

Report the acquisition or disposition of business

long as you apply your accounting methods consistently.

assets on Line 4 of PA Schedule C. Refer to the federal schedule

•

PA law does not contain provisions for statutory employees.

for an explanation for gain/loss items, but do not submit the

Federal statutory employees may be required to report PA

federal schedule.

taxable income on Line 1a, PA-40, and use PA Schedule UE

Form 8824.

Do not report a like-kind exchange on PA

to deduct expenses. See Chapter 7 of the PA PIT Guide for

Schedule C, unless it is a normal and recognized transaction in

more information.

your business or profession in accordance with APB 29. PA law

•

An owner may deduct all losses from a business or profession

does not have like-kind exchange provisions. You must include

in the taxable year realized. Report all transactions directly

the gain or loss from a sale, exchange or disposition of a busi-

related to your business or profession on PA Schedule C.

ness asset on Line 4 of PA Schedule C if the transaction was a

•

Do not use the installment method for sales of inventory if

normal business transaction. You must report any gain or loss

you sell such inventory in the regular and ordinary course

from the sale of a nonbusiness asset or property or the sale of

of a business or profession. Include interest on such sales

a business or segment thereof on PA Schedule D if the prop-

in gross receipts.

erty sold was not replaced.

Form 8829.

Maintain separate books and records for PA PIT purposes

Include your allowable expenses for the business

and file PA Schedule C. If you wish to take advantage of

use of your home on Line 34 of PA Schedule C. Refer to the

Pennsylvania reporting differences that decrease your federal

federal schedule for an explanation of this expense, but do not

profit, complete PA Schedule C.

submit the federal schedule. Pennsylvania does not recognize

PAGE 1

NEXT PAGE

1

1 2

2 3

3 4

4 5

5 6

6