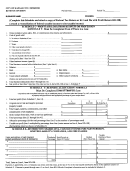

PA Schedule C

Profit or Loss from Business or

Profession (Sole Proprietorship)

PA-40 C (08-14) (FI)

PA DEPARTMENT OF REVENUE

federal income taxes or the one-half of self-employment taxes

and acknowledged publicly by the recipient. Personal

the IRS allows. Do not deduct taxes paid to other states or

charitable contributions are not allowed.

foreign countries based on income. Do not deduct estate,

•

Expenses using the capitalization rules established by your

inheritance, legacy, succession or gift taxes. Assessments for

trade, profession, or industry, under its generally accepted

betterments and improvements are not allowed. Business

accounting principles and practices. Once elected, use this

privilege taxes and/or gross receipts taxes are acceptable

method consistently.

deductions.

•

100 percent of expenses incurred for removing barriers to

Line 31.

Travel and entertainment. PA law does not follow

individuals with disabilities and the elderly. This is not a

federal law. Deduct 100 percent of your allowable travel and

credit but a direct expense in arriving at the net income

entertainment expenses. You may never deduct the personal

portion of your travel and entertainment expenses, whether for

or loss.

yourself, your spouse, your dependents or any other person.

•

Home office expenses. Pennsylvania generally follows the

Line 32.

Utilities. Certain utilities, which are not subject to

federal rules for a home office.

sales and use tax when purchased exclusively for residential

•

Any other expenses allowed under generally accepted

use, become subject to sales and use tax when used for com-

accounting principles or financial accounting standards

mercial purposes. If you are including electricity, natural gas,

board rules but are not allowable or limited under federal

fuel oil, or kerosene in your calculation of the business use of

rules. Itemize these expenses.

your home, you should report use tax due on the prorated

expense amount on Line 25 of the PA-40 or on the sales tax

Line 38.

Total expenses. Add Lines 6 through 37.

returns you file with the department.

Line 39.

Other business credits. If you claimed one or

Line 33.

Wages. Do not reduce your wage expense for any

more of these credits, reduce total expenses by costs to qualify

federal credits you claim. Add back any wage expense excluded

for the credit:

in order to claim a federal credit. Do not deduct the costs of

•

PA Employment Incentive Payments Credit

your own participation.

•

PA Job Creation Tax Credit

Line 34.

.

IDCs (1/3 current expensing)

If the business

includes an amount on this line, it elects to directly expense

•

PA Research and Development Tax Credit

up to one-third of the amount of Intangible Drilling and

If you did not claim one of these business credits, enter zero

Development Costs (IDCs) incurred for the tax year for any

on Line 39.

tax year beginning after December 31, 2013.

See the

Information Notice, Personal Income Tax 2013-04 for addi-

Line 40.

Total Adjusted Expenses. Reduce Line 38 by

tional information.

Line 39.

Line 35.

.

IDCs (amortization)

Report the amortization

Line 41.

Net profit or loss. Subtract Line 40 from Line 5. In

expense of IDCs incurred for all tax years on this line. IDCs

calculating net profit or loss from your business or profession,

incurred in tax years beginning prior to January 1, 2014 must

report your entire loss in this taxable year.

be amortized over the life of the well. IDCs incurred in tax

Schedule C-1 – Cost of goods sold and/or

years beginning after December 31, 2013 may be amortized

operations

over 10 years (120 months).

Generally, if you engaged in a trade or business in which the

Line 36.

Start-up costs (direct expense). Up to $5,000

production, purchase or sale of merchandise was an income-

of start-up costs may be directly expensed in the first year in

producing factor, you must consider inventories at the beginning

which the business begins operations for tax years beginning

after December 31, 2013. The department will follow IRC

and end of your tax year.

Section 195(b)(1)(A) regarding business start-up costs where

In determining inventory value, use the cost, lower of cost or

expenses over $5,000 must be amortized over 180 months

market or other method allowable under generally accepted

and any amount of expenses over $50,000 requires a direct

accounting principles and practices. If you change methods of

reduction in the direct expense amount. For tax years prior to

valuing inventory, restate the value at the beginning of the

January 1, 2104, start-up costs are required to be amortized

year based on the changed method, and include an explana-

over 180 months. Record only the direct expense amount of

tion. There is no provision under PA PIT law similar to IRC

start-up costs on Line 36 of PA Schedule C. Report the amor-

Section 481(a) that permits taxpayers to spread the income

tization of any start-up costs on Line 7 of PA Schedule C.

effect of a change in method over a specified period. PA PIT

Line 37.

Other expenses. Deduct any other costs of doing

rules also do not permit valuing inventory using uniform capi-

business or providing professional services if such costs are

talization rules under IRC section 263 A (a) and (b) and inven-

permitted under generally accepted accounting principles and

tories calculated using this method for federal purposes must

practices. Itemize the additional expenses you claim, and enter

be recalculated for PA PIT purposes.

the total on Line 37, Total other expenses. You may deduct:

•

Schedule C-2 – Depreciation

100 percent of the PA sales tax paid on a depreciable

business asset. However, on disposition, your Pennsylvania

Complete this schedule if you are using a depreciation method

basis and federal basis for that asset will be different.

other than federal depreciation reported on your Federal

•

Charitable contributions made from your business account

Schedule C. See the instructions for Line 13 on Page 3.

PAGE 4

RETURN TO SIDE ONE

1

1 2

2 3

3 4

4 5

5 6

6