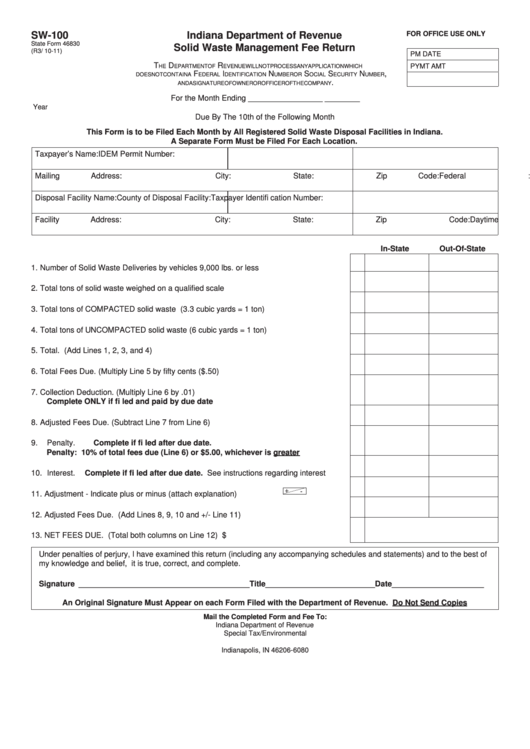

SW-100

Indiana Department of Revenue

FOR OFFICE USE ONLY

State Form 46830

Solid Waste Management Fee Return

(R3/ 10-11)

PM DATE

T

D

R

PYMT AMT

HE

EPARTMENT OF

EVENUE WILL NOT PROCESS ANY APPLICATION WHICH

F

I

N

S

S

N

,

DOES NOT CONTAIN A

EDERAL

DENTIFICATION

UMBER OR

OCIAL

ECURITY

UMBER

.

AND A SIGNATURE OF OWNER OR OFFICER OF THE COMPANY

For the Month Ending _________________ ________

Year

Due By The 10th of the Following Month

This Form is to be Filed Each Month by All Registered Solid Waste Disposal Facilities in Indiana.

A Separate Form Must be Filed For Each Location.

Taxpayer’s Name:

IDEM Permit Number:

Mailing Address:

City:

State:

Zip Code:

Federal I.D. Number:

Disposal Facility Name:

County of Disposal Facility:

Taxpayer Identifi cation Number:

Facility Address:

City:

State:

Zip Code:

Daytime Phone Number:

In-State

Out-Of-State

1.

Number of Solid Waste Deliveries by vehicles 9,000 lbs. or less ....................................

1

2.

Total tons of solid waste weighed on a qualifi ed scale ....................................................

2

3.

Total tons of COMPACTED solid waste (3.3 cubic yards = 1 ton) ..................................

3

4.

Total tons of UNCOMPACTED solid waste (6 cubic yards = 1 ton) ................................

4

5.

Total. (Add Lines 1, 2, 3, and 4) .....................................................................................

5

6.

Total Fees Due. (Multiply Line 5 by fi fty cents ($.50).......................................................

6

7.

Collection Deduction. (Multiply Line 6 by .01)

Complete ONLY if fi led and paid by due date .............................................................

7

8.

Adjusted Fees Due. (Subtract Line 7 from Line 6) ..........................................................

8

9.

Penalty. Complete if fi led after due date.

Penalty: 10% of total fees due (Line 6) or $5.00, whichever is greater ...................

9

10. Interest. Complete if fi led after due date. See instructions regarding interest ...........

10

+

-

11. Adjustment - Indicate plus or minus (attach explanation)................................................

11

12. Adjusted Fees Due. (Add Lines 8, 9, 10 and +/- Line 11) ..............................................

12

13. NET FEES DUE. (Total both columns on Line 12) .........................................................

13 $

Under penalties of perjury, I have examined this return (including any accompanying schedules and statements) and to the best of

my knowledge and belief, it is true, correct, and complete.

Signature _______________________________________ Title_________________________Date_____________________

An Original Signature Must Appear on each Form Filed with the Department of Revenue. Do Not Send Copies

Mail the Completed Form and Fee To:

Indiana Department of Revenue

Special Tax/Environmental

P.O. Box 6080

Indianapolis, IN 46206-6080

1

1 2

2