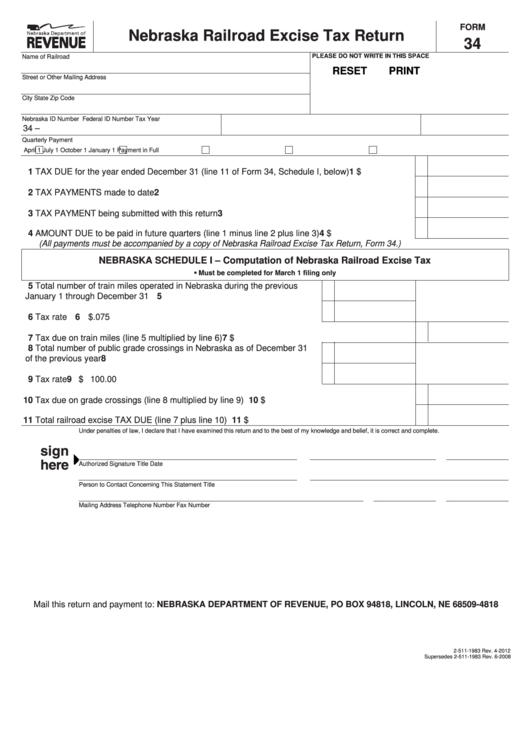

FORM

Nebraska Railroad Excise Tax Return

34

PLEASE DO NOT WRITE IN THIS SPACE

Name of Railroad

RESET

PRINT

Street or Other Mailing Address

City

State

Zip Code

Nebraska ID Number

Federal ID Number

Tax Year

34 –

Quarterly Payment

April 1

July 1

October 1

January 1

Payment in Full

1 TAX DUE for the year ended December 31 (line 11 of Form 34, Schedule I, below) ......................

1 $

2 TAX PAYMENTS made to date ........................................................................................................

2

3 TAX PAYMENT being submitted with this return ..............................................................................

3

4 AMOUNT DUE to be paid in future quarters (line 1 minus line 2 plus line 3) ..................................

4 $

(All payments must be accompanied by a copy of Nebraska Railroad Excise Tax Return, Form 34.)

NEBRASKA SCHEDULE I – Computation of Nebraska Railroad Excise Tax

• Must be completed for March 1 filing only

5 Total number of train miles operated in Nebraska during the previous

January 1 through December 31 ................................................................ 5

6 Tax rate ....................................................................................................... 6 $

.075

7 Tax due on train miles (line 5 multiplied by line 6) ...........................................................................

7 $

8 Total number of public grade crossings in Nebraska as of December 31

of the previous year .................................................................................... 8

9 Tax rate ....................................................................................................... 9 $

100.00

10 Tax due on grade crossings (line 8 multiplied by line 9)

10 $

11 Total railroad excise TAX DUE (line 7 plus line 10)

11 $

Under penalties of law, I declare that I have examined this return and to the best of my knowledge and belief, it is correct and complete.

sign

here

Authorized Signature

Title

Date

Person to Contact Concerning This Statement

Title

Mailing Address

Telephone Number

Fax Number

Mail this return and payment to: NEBRASKA DEPARTMENT OF REVENUE, PO BOX 94818, LINCOLN, NE 68509-4818

2-511-1983 Rev. 4-2012

Supersedes 2-511-1983 Rev. 6-2008

1

1 2

2