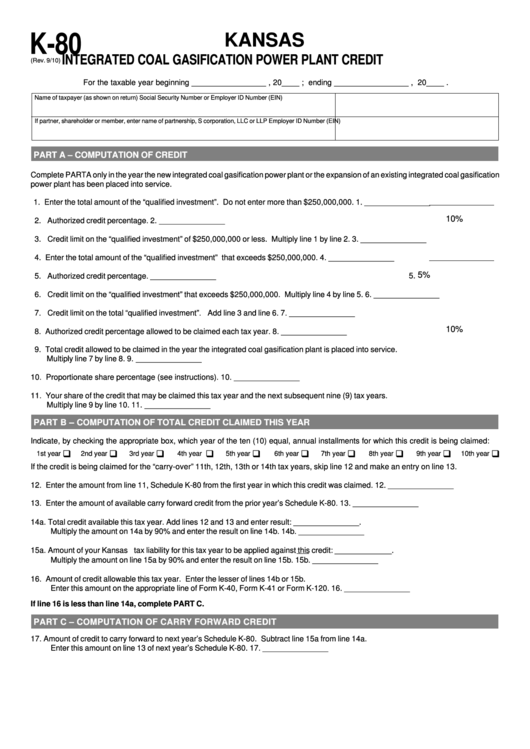

K-80

KANSAS

INTEGRATED COAL GASIFICATION POWER PLANT CREDIT

(Rev. 9/10)

For the taxable year beginning _________________ , 20____ ; ending _________________ , 20____ .

Name of taxpayer (as shown on return)

Social Security Number or Employer ID Number (EIN)

If partner, shareholder or member, enter name of partnership, S corporation, LLC or LLP

Employer ID Number (EIN)

PART A – COMPUTATION OF CREDIT

Complete PARTA only in the year the new integrated coal gasification power plant or the expansion of an existing integrated coal gasification

power plant has been placed into service.

1. Enter the total amount of the “qualified investment”. Do not enter more than $250,000,000.

1.

_______________

10%

2. Authorized credit percentage.

2.

_______________

3. Credit limit on the “qualified investment” of $250,000,000 or less. Multiply line 1 by line 2.

3.

_______________

4. Enter the total amount of the “qualified investment” that exceeds $250,000,000.

4.

_______________

5%

5. Authorized credit percentage.

5.

_______________

6. Credit limit on the “qualified investment” that exceeds $250,000,000. Multiply line 4 by line 5.

6.

_______________

7. Credit limit on the total “qualified investment”. Add line 3 and line 6.

7.

_______________

10%

8. Authorized credit percentage allowed to be claimed each tax year.

8.

_______________

9. Total credit allowed to be claimed in the year the integrated coal gasification plant is placed into service.

Multiply line 7 by line 8.

9.

_______________

10. Proportionate share percentage (see instructions).

10.

_______________

11. Your share of the credit that may be claimed this tax year and the next subsequent nine (9) tax years.

Multiply line 9 by line 10.

11.

_______________

PART B – COMPUTATION OF TOTAL CREDIT CLAIMED THIS YEAR

Indicate, by checking the appropriate box, which year of the ten (10) equal, annual installments for which this credit is being claimed:

�

�

�

�

�

�

�

�

�

�

1st year

2nd year

3rd year

4th year

5th year

6th year

7th year

8th year

9th year

10th year

If the credit is being claimed for the “carry-over” 11th, 12th, 13th or 14th tax years, skip line 12 and make an entry on line 13.

12. Enter the amount from line 11, Schedule K-80 from the first year in which this credit was claimed.

12.

_______________

13. Enter the amount of available carry forward credit from the prior year’s Schedule K-80.

13.

_______________

14a. Total credit available this tax year. Add lines 12 and 13 and enter result: _______________.

Multiply the amount on 14a by 90% and enter the result on line 14b.

14b. _______________

15a. Amount of your Kansas t ax liability for this tax year to be applied against this credit: _____________.

Multiply the amount on line 15a by 90% and enter the result on line 15b.

15b. _______________

16. Amount of credit allowable this tax year. Enter the lesser of lines 14b or 15b.

Enter this amount on the appropriate line of Form K-40, Form K-41 or Form K-120.

16.

_______________

If line 16 is less than line 14a, complete PART C.

PART C – COMPUTATION OF CARRY FORWARD CREDIT

17.

Amount of credit to carry forward to next year’s Schedule K-80. Subtract line 15a from line 14a.

Enter this amount on line 13 of next year’s Schedule K-80.

17.

_______________

1

1 2

2