Refund

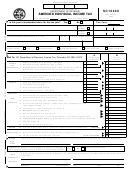

23. If line 22 is larger than line 11, column C, subtract and enter the difference . . . . . . . .

REFUND

23

(line 23a check box entry is required)

Direct Deposit

Refund

23a.

Mark one refund choice:

Debit Card*

Paper Check

(23b required)

Options

*SCDOR Income Tax Refund Prepaid Debit Card issued by Bank Of America

(subject to

23b.

Direct Deposit (for US Accounts Only) Type:

Checking

Savings

program

limitations)

Must be 9 digits. The first two numbers of the

Routing Number (RTN)

RTN must be 01 through 12 or 21 through 32

1-17 digits

Bank Account Number (BAN)

24. If line 11, column C is larger than line 22, enter the difference . . . . . . . . . . . . . . . . . . . . . . . . . .

Balance

24

Due

25. Interest and penalty on tax due (from due date of original return) . . . . . . . . . . . . . . . . . . . . . . . .

25

26. TOTAL: Add lines 24 and 25 and enter here . . . . . . . . . . . . . . . . . . . . TOTAL BALANCE DUE

26

I declare that this return and all attachments are true, correct and complete to the best of my knowledge and belief.

Please

Sign

Here

Your Signature

Date

Spouse's Signature (If filing jointly, BOTH must sign.)

I authorize the Director of the Department of Revenue or delegate to

Preparer's Printed Name

discuss this return, attachments and related tax matters with the

Yes

No

preparer.

If prepared by a person other than the taxpayer, his declaration is based on all information of which he has any knowledge.

Paid

Preparer's

Prepared by

Date

Address

Use Only

PTIN or FEIN

Phone Number

City

State

Zip

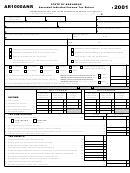

PART IV - NONRESIDENT

(

(It is best to make necessary corrections on a new Schedule NR

1) As Originally

(2) Correct

Reported

Amount

before completing the nonresident section of the SC1040X).

27.

Federal Adjusted Gross Income. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

27

28

28.

SC Adjusted Gross Income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

%

29

29.

Corrected Proration (line 28, column 2 divided by line 27, column 2). . . . . . . . . . . . . . . . . . . . .

30

30.

TOTAL Itemized (standard) Deductions and Exemptions (see instructions). . . . . . . . . . . . . . . .

31.

Allowable Itemized (standard) Deductions and Exemptions (multiply line 30, column 2 by

line 29.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

31

32.

Total SC Adjustments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

32

33.

Line 31 minus line 32, column 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

33

34.

Modified South Carolina taxable income as corrected (line 28, column 2 less line 33, column 2)

Enter results from column 2 to line 3 column C on front of SC1040X.

Compute tax and enter on line 4 column C on front of SC1040X. . . . . . . . . . . . . . . . . . . . .

34

PART V - EXPLANATION OF CHANGES Enter the line reference from PART II or PART IV for which you are reporting

a change and give the reason for each change. Attach applicable documentation.

Failure to provide an explanation or supporting documentation will result in a delay in processing your return.

Explanation:

Have you been advised that your original state return is being or will be audited by the SC Department of

Revenue?

Yes

No

Are you filing this amended return due to a Federal adjustment? If yes, attach a copy of the Federal Audit or

adjustment.

Yes

No

30832026

1

1 2

2 3

3 4

4 5

5 6

6