FILING AMENDED RETURNS

Form SC1040X should be used to correct or change an SC1040 that you have previously filed. SC1040X can be filed

only after you have filed an original return. By filing an amended return you are correcting our tax records. An amended

return is necessary if you omitted income, claimed deductions or credits you were not entitled to, failed to claim

deductions or credits you were entitled to, or changed your filing status. You should also file an amended return if you

were audited by the IRS (unless the IRS audit had no impact on your state return). Your amended return may result in

either a refund or additional tax. You must pay any additional tax with the amended return. Furnish all information

requested. When items are in question, refer to the instructions for preparing form SC1040, SC1040TC or I-319 when

applicable. Be sure to include a copy of your Federal 1040X if you were also required to amend your federal return.

Please round off all amounts to the nearest whole dollar. Any overpayments will be refunded. Overpayments cannot be

transferred to another tax year.

NOTE: South Carolina law does not allow a net operating loss carryback.

If you filed your original return by the original due date or by an extended due date, if applicable, you must file any claim

for refund within either:

three years from the date of filing or

three years from the original due date or

two years from the date of payment

If you filed your original return after the original due date and any extended due date, if applicable, you must file any claim

for refund within either:

three years from the original due date or

two years from the date of payment

Use the most current revision of this form regardless of tax year. The most current revision can be found on our

website at Tax Tables (SC1040TT) for prior years can also be found on our website. The year of the

tax table must match the tax year being amended.

INSTRUCTIONS FOR FILING AMENDED RETURNS

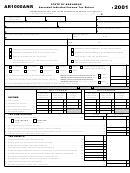

PART I - Taxpayer Information

Enter the tax year in the space provided.

Complete name and social security number for each taxpayer included in this return.

Provide most current mailing address including county code and telephone number.

For a foreign address, check the box indicating that the address is outside of the US. In the box provided print or type

the complete foreign address including postal code.

Mark the appropriate box for filing status. Generally, filing status should be the same as the filing status used on your

federal return.

Note: You cannot change your filing status from joint to separate returns after the due date of the

original return has passed.

Enter the number of exemptions claimed on your federal return.

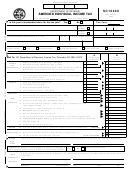

PART II - Return Information

Columns A Through C

Column A

Enter the amounts from your original return for lines 1-14 using figures reported or adjusted on your original return.

Enter the net increase or decrease for each line you are changing. Explain each change in Part V.

Column B

To figure the amounts to enter in this column:

Column C

• Add the increase in column B to the amount in column A, or

• Subtract the decreases in column B from the amount in column A.

For any amount you do not change, enter the amount from column A in column C. Show any negative numbers (losses or

decreases) in Columns A, B, or C in parentheses.

NOTE: Nonresident/part year resident taxpayers should complete Part IV prior to completing lines 3 -

26 of the SC1040X. Lines 1 and 2 do not apply to nonresident/part year residents.

1

1

1 2

2 3

3 4

4 5

5 6

6