EFO00033

Instructions for Idaho Form 49R

06-14-13

GENERAL INSTRUCTIONS

Line 5. Enter the month, day, and year the property ceased to

qualify as ITC property.

Use Form 49R to compute the increase in tax and reduction to

credit carryover for the recapture of investment tax credit (ITC).

Line 6. Do not enter partial years. If the property was held less

than 12 months, enter zero.

You must recompute the credit if you earned it in an earlier year,

but disposed of the property before the end of the five-year

recapture period. You must also recompute the credit on any

PART III

property ceasing to qualify as ITC property. Property moved

from Idaho within the first five years ceases to qualify as ITC

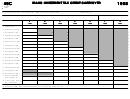

Line 7. Enter the appropriate recapture percentage from the

property and is subject to recapture.

following table.

Recapture may be necessary when:

If the number of full years

Then the recapture

on Form 49R, line 6 is...

percentage is...

● An S corporation shareholder's interest is reduced by a sale,

redemption or other disposition of the shareholder's stock, or

0

100

by the corporation's issuance of more shares.

● A partner's proportionate interest in the general profits of the

1

80

partnership (or in a particular item of property) is reduced.

2

60

● A trust's, estate's or beneficiary's proportionate interest in the

3

40

income of the trust or estate is reduced.

4

20

S corporations, partnerships, estates and trusts that pass

5 or more

0

through ITC to the shareholders, partners or beneficiaries

must provide Form ID K-1 reporting the recapture amount and

including in Part E, Supplemental Information, details on the

Line 9. Add all amounts on line 8. If you have used more

year(s) the credit being recaptured was originally earned.

than one Form 49R or separate sheets to list additional items

Any resulting tax from recapture of credits claimed in prior years

on which you computed an increase in tax, write to the left of

must be added to the tax otherwise determined in the year

the entry space "Tax from attached" and the total tax from the

of recapture. Recapture of credits not claimed in prior years

separate sheets. Include the amount in the total for line 9.

reduces the amount of credit carryover available to the current

year.

Line 10. Enter the amount of recapture of ITC that is being

passed to you from S corporations, partnerships, estates and

SPECIFIC INSTRUCTIONS

trusts. This amount is reported on Form ID K-1, Part D, line 12.

Instructions are for lines not fully explained on the form.

If recapture is necessary due to a reduction of a shareholder's

proportionate stock interest in an S corporation, reduction in the

interest in the general profits of a partnership, or reduction in the

PART I

proportionate interest in the income of the trust or estate, include

Lines A through E. Describe the property for which you must

that recapture on line 10 as well.

recompute the ITC. Fill in lines 1 through 8 in Parts II and III for

each property on which you are recomputing the credit. Use a

Line 11. Add lines 9 and 10 to determine the amount of credit

separate column for each item. Use an additional Form 49R, or

subject to recapture.

other schedule with the same information as required on Form

49R, if you have ITC recapture on more than five items.

Line 12. If you are a partnership, S corporation, trust or estate,

enter the amount of credit recapture that passed through to

partners, shareholders, or beneficiaries. Do not include any

PART II

recapture on this line for partners, shareholders, or beneficiaries

S corporations, partnerships, estates and trusts that have

for whom you are paying the tax.

credit subject to recapture must complete lines 1 through 9 to

determine the amount of credit recapture.

Line 13. If you did not use all the credit you originally computed

either in the year earned or in a carryover year, you will not have

Partners, shareholders and beneficiaries will use the information

to pay tax from recapture of the amount of the credit you did not

provided by the partnership, S corporation, trust or estate to

use.

report their pass-through share of the credit to be recaptured on

line 10. If the only recapture you're reporting is from a pass-

Compute the unused portion of the original credit from Form 49R,

through entity, skip lines 1 through 9 and begin on line 10.

line 4, or that was passed through to you from a partnership,

S corporation, trust or estate on a separate sheet and enter

Line 1. Enter the month, day, and year that the property was

the amount on this line. Do not enter more than the tax from

first available for service.

recapture on line 11.

Line 2. Enter the cost or other basis of the property used to

Line 15. This is the total increase in tax. Enter it on this line and

compute the original investment tax credit.

on Form 44, Part II, line 1. DO NOT use this amount to reduce

your current year's ITC from Form 49.

Line 4. Multiply line 2 by line 3 to compute the credit originally

earned for each property listed.

1

1 2

2