Form 706 (Rev. 8-2013)

Decedent’s social security number

Estate of:

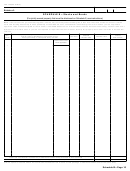

SCHEDULE M—Bequests, etc., to Surviving Spouse

Note. If the value of the gross estate, together with the amount of adjusted taxable gifts, is less than the basic exclusion amount and the

Form 706 is being filed solely to elect portability of the DSUE amount, consideration should be given as to whether you are required to

report the value of assets eligible for the marital or charitable deduction on this schedule. See the instructions and Reg. section 20.2010-2T

(a)(7)(ii) for more information. If you are not required to report the value of an asset, identify the property but make no entry in the last

column.

Yes

No

1

Did any property pass to the surviving spouse as a result of a qualified disclaimer? .

.

.

.

.

.

.

.

1

If ‘‘Yes,’’ attach a copy of the written disclaimer required by section 2518(b).

In what country was the surviving spouse born?

2a

What is the surviving spouse’s date of birth?

b

c

Is the surviving spouse a U.S. citizen? .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2c

If the surviving spouse is a naturalized citizen, when did the surviving spouse acquire citizenship?

d

If the surviving spouse is not a U.S. citizen, of what country is the surviving spouse a citizen?

e

3

Election Out of QTIP Treatment of Annuities. Do you elect under section 2056(b)(7)(C)(ii) not to treat as qualified

terminable interest property any joint and survivor annuities that are included in the gross estate and would

3

otherwise be treated as qualified terminable interest property under section 2056(b)(7)(C)? (see instructions) .

.

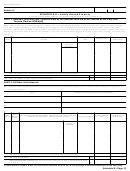

Item

Description of property interests passing to surviving spouse.

Amount

number

For securities, give CUSIP number. If trust, partnership, or closely held entity, give EIN

QTIP property:

A1

All other property:

B1

Total from continuation schedules (or additional statements) attached to this schedule .

.

.

.

.

.

.

.

4

Total amount of property interests listed on Schedule M

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4

5a Federal estate taxes payable out of property interests listed on Schedule M .

5a

.

.

b Other death taxes payable out of property interests listed on Schedule M .

5b

.

.

.

c Federal and state GST taxes payable out of property interests listed on Schedule M

5c

d Add items 5a, 5b, and 5c

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5d

6

Net amount of property interests listed on Schedule M (subtract 5d from 4). Also enter on Part 5—

6

Recapitulation, page 3, at item 21 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

(If more space is needed, attach the continuation schedule from the end of this package or additional statements of the same size.)

Schedule M—Page 20

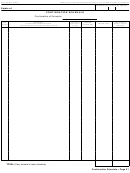

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31