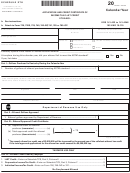

Instructions For Schedule Rc - Application For Income Tax/llet Credit For Recycling And/or Composting Equipment Or Major Recycling Project Page 2

ADVERTISEMENT

41A720RC(I) (10-13)

Page 2

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

into a material which can easily and safely be stored,

the Department of Revenue, Division of Corporation Tax,

handled, and used in a[n] environmentally acceptable

(502) 564-8139.

manner.

When and Where to File Application—This application

must be filed with the Department of Revenue, Division

The following items may qualify as composting and recycling

of Corporation Tax, Station 52, 501 High Street, Frankfort,

equipment if the conditions below are met:

Kentucky 40601, on or before the first day of the seventh

Balers

Lift-gate

month following the close of the taxable year in which

Bob Cat

Magnetic Separators

the qualifying equipment was purchased (installed).

Applications bearing a postmark after the above date will

Briquetters

Material Recovery Facility

Equipment

not be approved. Prior approval must be obtained before

claiming the credit. Only one application must be filed

Compactors

Pallet Jacks

for all purchases qualifying during the taxable period

Containers

Perforators

for which the application is being filed. The original

Conveyors

Pumps with Oil

copy of the approved application will be returned to

the purchaser.

Conveyor Systems

Scales

Crane with Grapel Hook

Screeners

Signature—The application must be signed by the applicant

Crushers

Shears

or other authorized person. Unsigned applications will be

returned.

Densifyers

Shredders

End Loaders

Tractor

SPECIFIC INSTRUCTIONS

Exhaust Fans

Trailer

Check Box—If a Major Recycling Project, check the box and

Fluffers

Trucks and Roll-offs

complete Part I and page 2.

Fork Lifts

Two-wheel Carts

Pass-through Entities—The total approved recycling and/or

Granulators

Vacuum Systems

composting equipment or major recycling project credit shall

be reported on Form 720S, Schedule K, Line 16; or on Form

The conditions are as follows:

765 or 765-GP, Schedule K, Line 17.

PART I—Composting and/or Recycling Equipment

(1)

Recycling or composting equipment shall be used

exclusively within this state for recycling or composting

Part I shall be completed for a Major Recycling Project also.

postconsumer waste materials.

Taxpayers must complete only Columns A through F of this

part and the description portion for each type of equipment

(2)

Recycling equipment or composting equipment is limited

listed in Column A. If more than two types of equipment were

to the purchase and installation cost of equipment and

purchased during the taxable year, use Schedule RC-C.

does not include repairs, including major repairs which

are capitalized and depreciated.

Column A—Enter the specific name of the machinery,

equipment or apparatus. For each item listed, give a brief

(3)

Recycling equipment or composting equipment

and concise description of the means by which it is used

does not include an equipment lease required to be

exclusively in the composting or recycling process.

capitalized and depreciated by the lessee for federal

Column B—Enter the name of the city, or if not a city, the

income tax purposes.

county, in Kentucky where the qualifying equipment or

machinery is located.

(4)

Manufacturing

equipment

used

exclusively

to

produce finished products composed of “substantial”

Column D—Enter the installation date, if applicable. If

postconsumer waste means the finished product shall

installation is required, enter the date the installation is

contain postconsumer waste of at least fifty percent

completed and the equipment is ready for use.

(50%) or more.

Column E—Enter the purchase price or contract price of the

For example, a can crusher is recycling equipment but home

qualifying equipment or machinery purchased. Round the

trash containers or trash bin collectors and other similar items

amount(s) entered to the nearest whole dollar.

used for collecting and/or separating postconsumer waste

Column F—Enter the cost of installing the equipment or

are not recycling equipment.

machinery to make it ready for use. Installation cost includes

shipping charges incurred and paid by the purchaser. Round

A self-contained "backyard composter" is composting

equipment but lawn tractors, mowers and mulching or

the amount(s) entered to the nearest whole dollar. Generally,

bagging attachments and other similar equipment used to

the total amount of Columns E and F should equal the

gather organic waste for composting are not composting

cost basis allowable for Kentucky depreciation purposes.

equipment.

Invoices, installation contracts and any other documentation

necessary to verify cost of equipment and installation must

This list is not all-inclusive. If you have a question about

be submitted to the Department of Revenue at the time the

whether a specific item is eligible under the law, contact

application is submitted.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3