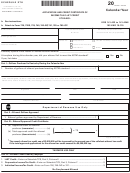

Instructions For Schedule Rc - Application For Income Tax/llet Credit For Recycling And/or Composting Equipment Or Major Recycling Project Page 3

ADVERTISEMENT

41A720RC(I) (10-13)

Page 3

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

Column G—Do not complete Column G. This column is to

PART V—Credit Calculation

be completed by the Department of Revenue to determine

Complete this part once you have received the approved

the total expense qualifying for the tax credit.

application from the Department of Revenue. Partners /

members/shareholders will complete this part based upon their

Identify the Equipment and Use—For the item of equipment

specific tax information. Their share of the approved credit will

listed, attach copies of vender invoices or other documentation

be reported on Kentucky Schedule K-1.

showing the purchase price and installation cost of the

equipment. Also, describe how the equipment will be used for

The credit for a Major Recycling Project may be claimed

recycling or composting postconsumer waste materials.

against the LLET (corporations and limited liability pass-

through entities) and income tax (entities subject to the

Vendor invoices and other documentation must be reconciled

tax imposed under KRS 141.020 or 141.040). The amount of

to the cost of each item of equipment and the installation

credit claimed for each tax may be different, and separate

cost of each item of equipment included on Schedule RC and

balances must be maintained.

Schedule RC-C. If the department is unable to reconcile the

vendor invoices and other documentation to each item of

Line 3—Enter the tax liability for the most recent tax year

equipment or the installation cost of each item of equipment

ending prior to January 1, 2005. The LLET baseline is

included on Schedule RC and Schedule RC-C, the application

zero (-0-).

will not be approved until all information is received. To

Line 7—Once the amount of credit is determined, enter here

assist in the reconciliation, a spreadsheet showing each

and in Part VI, Column C, LLET. Next, combine the LLET

item of cost for each item of equipment should be attached

credit claimed here with the LLET credit claimed in Part

to Schedule RC and Schedule RC-C.

II and enter the total on Schedule TCS, Part II, Column E.

The credit claimed cannot reduce the LLET below the $175

PART II—Credit Approved

minimum.

Do not complete this part. It will be used by the Department

Line 8—Once the amount of credit is determined, enter

of Revenue to show the amount of tax credit approved.

here and in Part VI, Column C, Income. Next, combine the

income tax credit claimed here with the income tax credit

PART III—Amount of Credit Claimed

claimed in Part II and enter the total on Schedule TCS, Part

(Do not record the credit for a Major Recycling Project in

II, Column F.

Part III.) Entities subject to the LLET record the amount of

PART VI—Amount of Credit Claimed

approved credit claimed against the LLET in the LLET column

for each taxable year. Individuals or entities other than

Individuals or entities other than general partnerships

pass-through entities record the amount of approved credit

use this part to record the amount of the approved major

claimed against the income tax in the Income Tax column

recycling project credit and the amount of credit claimed for

for each taxable year. Enter the current year credit claimed

each taxable year. If no credit is taken, enter zero (-0-). The

against the LLET and/or income tax on the appropriate line

credit is limited to a period of 10 years commencing with the

of the Kentucky tax return or Schedule TCS.

approval of the recycling credit application. Attach a copy

of the approved application, including the entries made to

Attach a copy of the approved application, including the

date, to the Kentucky tax return for each year for which any

entries made to date in this part, to the Kentucky tax return

approved credit reflected by this application is claimed.

for each year for which any approved credit reflected by

this application is claimed.

Column B—In the year the credit is approved, enter in both

the LLET column and Income column the major recycling

Recording the Tax Credit—Enter in the applicable column(s)

project credit approved by the Department of Revenue.

on Schedule TCS, Part II, the recycling/composting and major

The approved credit is the same for LLET and income tax

recycling project credits being claimed against the LLET and/

purposes. For subsequent years, the balance of the LLET

or income tax on Form 720. Enter on Schedule TCS, Part II,

credit and Income credit will be the amount of Column B

Column E, the recycling/composting and major recycling

less Column C for the LLET column and Income column,

project credits being claimed against the LLET on Form

respectively.

720S, 725 or 765. Credits cannot exceed the limitations set

forth in KRS 141.390 or reduce the LLET tax liability below

Note: The 2007 beginning balance of the Major Recycling

the $175 minimum.

Project tax credit for LLET will be the same as the balance

for income tax purposes.

For income tax purposes, pass-through entities must enter

the credit approved by the Department of Revenue on

Column C—For each year the credit is claimed against LLET,

Schedule K.

enter in the LLET column the amount of the credit from Part

V, Line 7. For each year the credit is claimed against income

MAJOR RECYCLING PROJECT

tax, enter in the Income column the amount of the credit

from Part V, Line 8 or 9.

PART IV—Requirements Questionnaire

Answer all questions. If yes to all three questions, continue

to Part V.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3