BACKGROUND

Section 7122 of the Internal Revenue Code (IRC) allows delegated Alcohol and Tobacco Tax and Trade Bureau (TTB) officials to compromise any civil or

criminal case.

TTB ASSISTANCE

TTB will discuss the offer process with you, will assist you in determining a reasonable offer amount, based on the issues of the case and your ability to pay,

and will provide other appropriate assistance, as necessary.

POLICY

Tax Related Offer in Compromise. TTB will compromise a tax liability when there is doubt as to liability (i.e., there is doubt as to whether the taxpayer actu-

ally owes the amounts TTB has determined are due) or doubt as to collectibility (i.e., there is doubt that the taxpayer will be able to pay the full amount due

immediately or in the future). You might submit an offer based on doubt as to collectibility when you feel you cannot pay the full amount due. You might sub-

mit an offer based on doubt as to liability when you believe that you do not owe the tax in question. In some cases, both doubt as to liability and doubt as to

collectibilty may apply to the same case. In cases in which an offer is inappropriate, TTB will discuss other options which may be used in resolving your liabil-

ity, such as full payment, payment agreements, or other methods.

Non-Tax Related Offer in Compromise. TTB will compromise violation of laws and regulations when (a) the proponent has taken corrective action needed

to prevent reoccurrence of the violations and (b) the nature of the violations, compliance history of the proponent, and other evidence associated with the

case indicate that acceptance of the offer is the best means available to ensure future compliance. Offers of this nature are usually considered when an in-

vestigation discloses violations that are not strong enough to warrant criminal prosecution or permit action (if applicable).

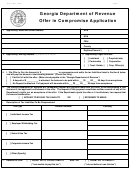

INSTRUCTIONS

Item No.

1. Enter your full name and address.

2. Enter your employer identification number (EIN), or if you have no EIN, your social security number (SSN).

3. This item should clearly state what you wish to compromise. Indicate which sections of the law and regulations you wish to compromise and the

date(s) and period(s) of violations. If you are making an offer to compromise a tax liability, the type(s) of tax(es) and the amount of the liability,

including a breakdown showing how much of the liability is tax, penalty and interest, as applicable, and the tax period(s) involved.

The description of the liability must be specific and complete so there will be no misunderstanding concerning the liability or liabilities and/or

section(s) of the law and regulations which will be compromised.

4. FOR TAX LIABILITY OFFERS -- TTB can compromise the amount owed for any of the following reasons:

a. doubt as to collectibility, i.e., doubt as to the amount of your resources from which TTB may be able to collect the full amount owed (refer to

“FINANCIAL STATEMENT” below).

b. doubt as to liability, i.e., doubt as to whether you owe the amount. Please check one or both reasons for the offer.

5. Provide a thorough discussion of the facts and reasons for submitting the offer along with a justification why TTB should accept this offer.

6. Enter the total amount of your offer, whether you are submitting full payment at the time you submit the offer or not. If you are requesting a deferred

payment agreement, also indicate:

a. how much you are submitting at the time you submit your offer along with a statement explaining why this is the largest amount you can pay at

this time; and

b. when (specific dates) you will make future payments and how much each payment will be.

7. For offer forms submitted by individuals or a sole proprietorship, each individual who intends to be covered by the offer in compromise should sign

and date the form. For a corporation or partnership, the form should be signed and dated by a person who has previously filed a Power of Attorney,

TTB F 5000.8, with TTB or submits such form along with this offer form.

8. FOR TTB USE ONLY

This section will be signed by an authorized TTB official once the offer is correctly and sufficiently submitted.

REMITTANCE WITH OFFER

Once page 1 of this form has been completed (excluding those items to be completed by TTB), forward the form along with a remittance payable to the Alco-

hol and Tobacco Tax and Trade Bureau. If this offer is paid in full at the time it is filed, indicate in item 6 the total sum of the offer. If this is a deferred payment

offer (payment agreement offer), indicate in item 6 the amount submitted at the time of filing this offer and the amount of each payment and the date each

payment will be made.

“WHERE TO FILE YOUR OFFER” on page 4 of this form will provide the address for filing your offer with TTB. For your records you may photocopy pages 1

and 2 of this form prior to filing with TTB.

FINANCIAL STATEMENT

If you submit your offer on the basis of doubt as to collectibility and TTB has not previously requested a current financial statement, you must attach to the

offer a completed TTB F 5600.17, Collection Information Statement for Individuals, and/or TTB F 5600.18, Collection Information Statement for Businesses.

PAGE 2 OF 5

TTB F 5640.1 (02/2008)

1

1 2

2 3

3 4

4 5

5