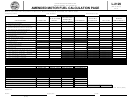

Form L-2123 - Miscellaneous Motor Fuel Monthly Return Page 2

ADVERTISEMENT

INSTRUCTIONS FOR L-2123

MISCELLANEOUS LICENSE USER FEE RETURN

Provide all information requested on the user fee return. Due Date - The return is due on the 22nd of the next month.

Column Information:

Fed Exempt Dyed Diesel: Applies to entities that are fully exempt from the federal excise tax and are

qualified to use dyed diesel for on road use.

Kerosene: Use to report kerosene gallons blended with diesel/biodiesel fuels.

LP Gas: Use to report liquid propane gas.

CNG/LNG: Use to report compressed natural gas and/or liquefied natural gas.

Other: Use for all biodiesel clear and dyed, biodiesel blends clear and dyed and all other products not covered

by one of the previous columns.

LINE 1 - GALLONS SOLD FOR USE IN HIGHWAY VEHICLES -

Not Applicable for Fed Exempt Dyed Diesel Column

Use this line to report the total number of user fee free gallons sold by product type as motor fuel for use in a

highway vehicle. This should be gallons on which the $0.16 motor fuel user fee has not previously been paid.

End users should enter a zero on this line.

LINE 2 - GALLONS USED IN HIGHWAY VEHICLES

Use this line to report the total number of gallons by product type of user fee free gallons that were used as

motor fuel in a highway vehicle.

LINE 3 - TOTAL GALLONS SUBJECT TO THE MOTOR FUEL USER FEE

Add Lines 1 and 2 for each product type.

LINE 4 - GALLONS SUBJECT TO THE OTHER APPLICABLE FEES

From Line 3 enter the total number of gallons from the CNG/LNG and the Other columns.

SPECIAL FUELS USER FEE DUE - LINE 5

From Line 3 add the gallons for all product types to calculate the total gallons subject to the user fee and

multiply the total by $0.16.

OTHER APPLICABLE FEES DUE - LINES 9 AND 13 (Inspection and Environmental Fees)

From Line 4 add the gallons for CNG/LNG and Other columns to calculate the total gallons subject to the other

applicable fees. Multiply the total gallons from Line 4 by $0.0025 to calculate the amount to be listed on Line 9.

Multiply the total gallons from Line 4 by $0.0050 to calculate the amount to be listed on line 13.

PENALTY - LINES 6, 10 AND 14

Failure to file a return will result in a penalty of five percent (5%) for the first month plus five percent (5%) for

each additional month not to exceed a total of twenty-five percent (25%). Failure to pay will result in penalties of

one half of one percent (.5%) per month not to exceed twenty-five percent (25%). Other penalties may apply.

INTEREST - LINES 7, 11, AND 15

Interest on all overdue accounts will be assessed at the rate provided under Sections 6621 and 6622 of the

Internal Revenue Code. Rates will change quarterly depending on the prime rate. In addition, interest will be

compounded daily.

TOTAL USER FEE/OTHER APPLICABLE FEES DUE - LINES 8, 12, AND 16

Add any penalty (Lines 6, 10, and 14) and interest due (Lines 7, 11, and 15) to the user fees and other

applicable fees calculated (Lines 5, 9, and 13) and enter the total user fee/other applicable fee plus penalty and

interest.

LINE 17 - TOTAL FEES DUE, PLUS PENALTY AND INTEREST

Add the total due lines together (Lines 8, 12, and 16) to calculate the total payment to be made with the user

fee return.

Make the check payable to the SC Department of Revenue.

If you have any questions or need assistance calculating penalty and interest, please call this office at (803) 896-1990.

44681013 L-2123 I

(Rev. 12/13/13) 4468

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2