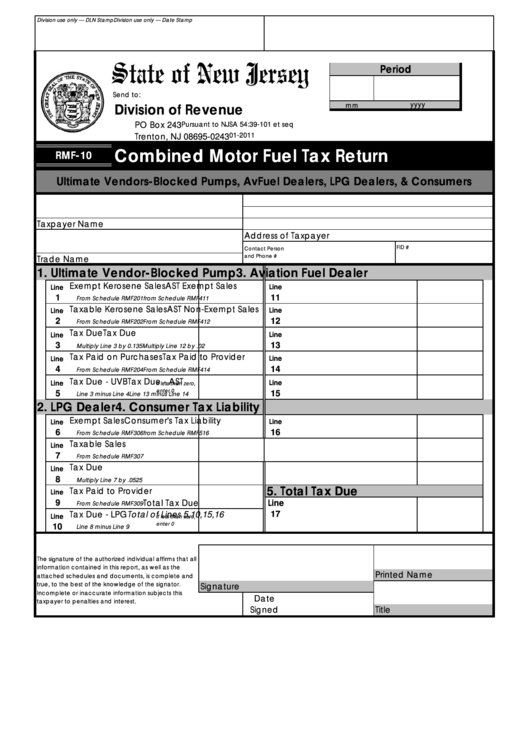

Form Rfm-10 - Combined Motor Fuel Tax Return - State Of New Jersey Division Of Revenue

ADVERTISEMENT

Division use only — DLN Stamp

Division use only — Date Stamp

Period

Send to:

yyyy

Division of Revenue

mm

PO Box 243

Pursuant to NJSA 54:39-101 et seq

01-2011

Trenton, NJ 08695-0243

Combined Motor Fuel Tax Return

RMF-10

Ultimate Vendors-Blocked Pumps, AvFuel Dealers, LPG Dealers, & Consumers

Taxpayer Name

Address of Taxpayer

FID #

Contact Person

and Phone #

Trade Name

1. Ultimate Vendor-Blocked Pump

3. Aviation Fuel Dealer

Exempt Kerosene Sales

AST Exempt Sales

Line

Line

1

11

From Schedule RMF201

from Schedule RMF411

Taxable Kerosene Sales

AST Non-Exempt Sales

Line

Line

2

12

From Schedule RMF202

From Schedule RMF412

Tax Due

Tax Due

Line

Line

3

13

Multiply Line 3 by 0.135

Multiply Line 12 by .02

Tax Paid on Purchases

Tax Paid to Provider

Line

Line

4

14

From Schedule RMF204

From Schedule RMF414

Tax Due - UVB

Tax Due - AST

Line

Line

if less than zero,

enter 0

5

15

Line 3 minus Line 4

Line 13 minus Line 14

2. LPG Dealer

4. Consumer Tax Liability

Exempt Sales

Consumer's Tax Liability

Line

Line

6

16

From Schedule RMF306

from Schedule RMF516

Taxable Sales

Line

7

From Schedule RMF307

Tax Due

Line

8

Multiply Line 7 by .0525

5. Total Tax Due

Tax Paid to Provider

Line

9

Line

Total Tax Due

From Schedule RMF309

Tax Due - LPG

17

Total of Lines 5,10,15,16

Line

if less than zero,

enter 0

10

Line 8 minus Line 9

The signature of the authorized individual affirms that all

information contained in this report, as well as the

Printed Name

attached schedules and documents, is complete and

true, to the best of the knowledge of the signator.

Signature

Incomplete or inaccurate information subjects this

Date

taxpayer to penalties and interest.

Signed

Title

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11