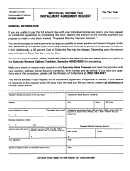

Purpose of Form

Form Instructions

Use this form to request a monthly payment plan if you

Enter your name and social security number or the name

cannot pay the full amount you owe on your

and federal identification number (EIN) of your business.

miscellaneous tax return (or on a billing notice we sent

If you are a sole proprietor with employees enter your

you). Generally, you may have up to 24 months to pay if

EIN and social security number.

the tax due is less than $5,000.

Line 4

If you cannot pay the full amount you owe now, pay as

Use this form if you need to request a payment

much as possible to lower the amount of penalty and

agreement for any of the following tax types:

interest you will be assessed.

Cigarette Tax

Tobacco Tax

Municipal Energy

Emergency Services Telecom

Line 5

Municipal Telecom License Fee Insurance Premium

If this request for payment agreement is submitted at the

Self Insurance

Inheritance Tax

same time you are filing your return, attach this form to

Gross Receipts

Radioactive Waste

the front of your return. The instructions for your tax

Beer

Multichannel Audio-Visual

Lubricating Oil

Brine Shrimp

return will tell you how to make the payment.

Sexually Explicit Business

If this form is being filed by itself, such as in response to

Bankruptcy

a billing notice, include a check or money order payable

If you are in bankruptcy do not use this form. Instead, call

to the Utah State Tax Commission.

Do not send cash.

801-297-6219 or if you are out of the Salt Lake area 1-

Be sure the following is shown on your check or money

800-662-4335 extension 6219.

order:

How Does the Agreement Process Work?

1. Business name and EIN or individual name and

You must have filed a return for all prior years or tax

social security number.

periods. List the years for which you have not filed a tax

2. The type of return, tax period or tax year and

return. If you are unable to file a return due to lost

account number (example, “

Cigarette

Tax

,

records you need to estimate your liability. Your payment

April 2009, acct 123456789”).

agreement will not be approved until all returns have

been filed. If you have questions or need a payoff

Line 6

Enter the day of the month you want the payment due.

amount, contact us at 801-297-3566.

This is the day the payment must be received by the Tax

If your request is approved, we will send you a letter to

Commission. Note: If you are mailing your payment,

confirm your monthly payment amount and the number

allow 3 to 5 days for mail delivery.

of required payments. It will also explain how to make

your first payment. You will have the following payment

Signatures

The individual or business owner must sign the request.

options:

Submit to:

1.

Pay by mail with check or money order.

Utah State Tax Commission

2.

Pay in person at one of our offices.

Miscellaneous Tax

3.

Pay by electronic check (direct debit) from your

210 N 1950 W

checking or savings account at

SLC, UT 84134-3500

taxexpress.utah.gov

.

or fax to: 801-297-3502

By approving your request we agree to let you pay the

tax you owe in monthly payments instead of immediately

paying the tax in full. In return you agree to make your

monthly payments on time. You also agree to

meet all of

your future tax liabilities

.

Any refund due you in a future year or tax period will be

applied against the amount you owe.

Important Note

: Failure to make your payments on time

or failure to file and/or pay future returns when due, will

break your payment agreement. If you break the

agreement we can take action to collect the tax you owe

in full and place liens on your real and tangible personal

property. Business owners and officers of corporations,

S-corporations and limited liability companies may be

assessed a penalty equal to 100 percent of the tax due

and liens can be filed against real and personal property.

1

1 2

2