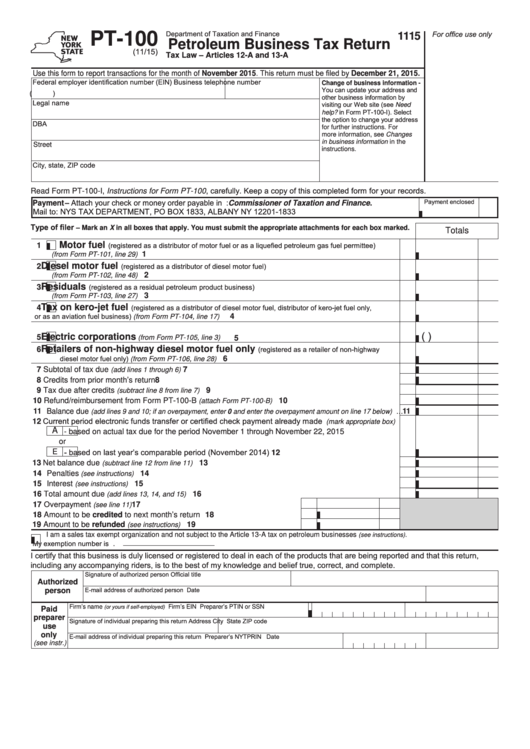

Form Pt-100 - Petroleum Business Tax Return

ADVERTISEMENT

Department of Taxation and Finance

For office use only

PT-100

1115

Petroleum Business Tax Return

(11/15)

Tax Law – Articles 12-A and 13-A

Use this form to report transactions for the month of November 2015. This return must be filed by December 21, 2015.

Federal employer identification number (EIN)

Business telephone number

Change of business information -

You can update your address and

(

)

other business information by

Legal name

visiting our Web site (see Need

help? in Form PT-100-I). Select

the option to change your address

DBA

for further instructions. For

more information, see Changes

in business information in the

Street

instructions.

City, state, ZIP code

Read Form PT-100-I, Instructions for Form PT-100, carefully. Keep a copy of this completed form for your records.

Payment – Attach your check or money order payable in U.S. funds to: Commissioner of Taxation and Finance.

Payment enclosed

Mail to: NYS TAX DEPARTMENT, PO BOX 1833, ALBANY NY 12201-1833

Type of filer

– Mark an X in all boxes that apply. You must submit the appropriate attachments for each box marked.

Totals

Motor fuel

(registered as a distributor of motor fuel or as a liquefied petroleum gas fuel permittee)

1

..................................................................................................................

1

(from Form PT-101, line 29)

Diesel motor fuel

(registered as a distributor of diesel motor fuel)

2

..................................................................................................................

2

(from Form PT-102, line 48)

(registered as a residual petroleum product business)

Residuals

3

..................................................................................................................

3

(from Form PT-103, line 27)

Tax on kero-jet fuel

(registered as a distributor of diesel motor fuel, distributor of kero-jet fuel only,

4

or as an aviation fuel business) (from Form PT-104, line 17) ...............................................................................

4

(

)

Electric corporations

5

.......................................................................

(from Form PT-105, line 3)

5

Retailers of non-highway diesel motor fuel only

(registered as a retailer of non-highway

6

diesel motor fuel only) (from Form PT-106, line 28)

..................................................................................

6

7 Subtotal of tax due

.................................................................................................

7

(add lines 1 through 6)

8 Credits from prior month’s return .............................................................................................................

8

9 Tax due after credits

........................................................................................

9

(subtract line 8 from line 7)

10 Refund/reimbursement from Form PT-100-B

....................................................... 10

(attach Form PT-100-B)

11 Balance due

... 11

(add lines 9 and 10; if an overpayment, enter 0 and enter the overpayment amount on line 17 below)

12 Current period electronic funds transfer or certified check payment already made

(mark appropriate box)

A

- based on actual tax due for the period November 1 through November 22, 2015

or

- based on last year’s comparable period (November 2014) .................................................. 12

E

13 Net balance due

........................................................................................... 13

(subtract line 12 from line 11)

14 Penalties

....................................................................................................................... 14

(see instructions)

15 Interest

.......................................................................................................................... 15

(see instructions)

16 Total amount due

............................................................................................... 16

(add lines 13, 14, and 15)

17 Overpayment

........................................................................... 17

(see line 11)

18 Amount to be credited to next month’s return ........................................... 18

19 Amount to be refunded

................................................... 19

(see instructions)

I am a sales tax exempt organization and not subject to the Article 13-A tax on petroleum businesses

.

(see instructions)

My exemption number is

.

I certify that this business is duly licensed or registered to deal in each of the products that are being reported and that this return,

including any accompanying riders, is to the best of my knowledge and belief true, correct, and complete.

Signature of authorized person

Official title

Authorized

E-mail address of authorized person

Date

person

Firm’s name

Firm’s EIN

Preparer’s PTIN or SSN

(or yours if self-employed)

Paid

preparer

Signature of individual preparing this return

Address

City

State

ZIP code

use

only

E-mail address of individual preparing this return

Preparer’s NYTPRIN

Date

(see instr.)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1