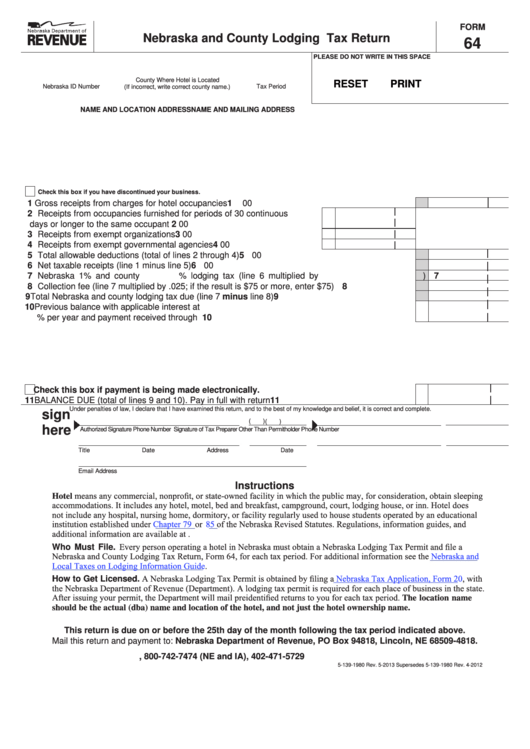

FORM

Nebraska and County Lodging Tax Return

64

PLEASE DO NOT WRITE IN THIS SPACE

County Where Hotel is Located

RESET

PRINT

Nebraska ID Number

Tax Period

(If incorrect, write correct county name.)

NAME AND LOCATION ADDRESS

NAME AND MAILING ADDRESS

Check this box if you have discontinued your business.

1 Gross receipts from charges for hotel occupancies ..........................................................................

1

00

2 Receipts from occupancies furnished for periods of 30 continuous

days or longer to the same occupant ........................................................

2

00

3 Receipts from exempt organizations ..........................................................

3

00

4 Receipts from exempt governmental agencies ..........................................

4

00

5 Total allowable deductions (total of lines 2 through 4) ........................................................................

5

00

6 Net taxable receipts (line 1 minus line 5) ...........................................................................................

6

00

7 Nebraska 1% and county

% lodging tax (line 6 multiplied by

) .......

7

8 Collection fee (line 7 multiplied by .025; if the result is $75 or more, enter $75) ................................

8

9 Total Nebraska and county lodging tax due (line 7 minus line 8) ......................................................

9

10 Previous balance with applicable interest at

% per year and payment received through

10

Check this box if payment is being made electronically.

11 BALANCE DUE (total of lines 9 and 10). Pay in full with return ........................................................ 11

Under penalties of law, I declare that I have examined this return, and to the best of my knowledge and belief, it is correct and complete.

sign

(

)

(

)

here

Authorized Signature

Phone Number

Signature of Tax Preparer Other Than Permitholder Phone Number

Title

Date

Address

Date

Email Address

Instructions

Hotel means any commercial, nonprofit, or state-owned facility in which the public may, for consideration, obtain sleeping

accommodations. It includes any hotel, motel, bed and breakfast, campground, court, lodging house, or inn. Hotel does

not include any hospital, nursing home, dormitory, or facility regularly used to house students operated by an educational

institution established under

Chapter 79

of the Nebraska Revised Statutes. Regulations, information guides, and

or

85

additional information are available at

Who Must File. Every person operating a hotel in Nebraska must obtain a Nebraska Lodging Tax Permit and file a

Nebraska and County Lodging Tax Return, Form 64, for each tax period. For additional information see the

Nebraska and

Local Taxes on Lodging Information

Guide.

How to Get Licensed. A Nebraska Lodging Tax Permit is obtained by filing a

Nebraska Tax Application, Form

20, with

the Nebraska Department of Revenue (Department). A lodging tax permit is required for each place of business in the state.

After issuing your permit, the Department will mail preidentified returns to you for each tax period. The location name

should be the actual (dba) name and location of the hotel, and not just the hotel ownership name.

This return is due on or before the 25th day of the month following the tax period indicated above.

Mail this return and payment to: Nebraska Department of Revenue, PO Box 94818, Lincoln, NE 68509-4818.

, 800-742-7474 (NE and IA), 402-471-5729

5-139-1980 Rev. 5-2013 Supersedes 5-139-1980 Rev. 4-2012

1

1 2

2