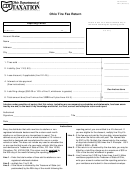

When and Where to File. This return, properly signed and accompanied by a check or money order payable to the Nebraska

Department of Revenue, is considered timely filed if U.S. postmarked on or before the 25th day of the month following the

reporting period covered by this return. A return is required for each reporting period even when no tire fee is due. Mail the

return and payment to the Nebraska Department of Revenue, PO Box 94818, Lincoln, Nebraska 68509-4818.

Preidentified Return. This return is to be used only by the Nebraska Tire Fee permitholder whose name is printed on it.

If you have not received a preidentified return for a particular period, request a duplicate from the Department. Do not file

returns which are photocopies, returns from a previous reporting period, or returns which have not been preidentified.

You may change the names and addresses printed on this return, provided the changes are not being made because of an

ownership change or a change in your federal ID number.

To change the location or mailing name and address, mark through the incorrect information and plainly print the correct

information. In addition, write on the face of the return, “name or address change only.” The location address cannot be a

post office box number.

If you are changing the name or address of the business because of a: (1) change in ownership; (2) change in the legal form

of the business (for example, from a proprietorship to a corporation); or (3) change in your federal ID number, you must

20, to obtain new permits, licenses, and certificates. The former owner

complete and return a

Nebraska Tax Application, Form

of the business must cancel all of their permits, licenses, and certificates by filing a

Nebraska Change Request, Form

22.

Penalty and Interest. If the return is not filed by the due date, or when the tire fee is due but not paid by the due date, a

penalty will be assessed in the amount of $25 or ten percent of the tax due, whichever is greater. Interest on the unpaid fee

will be assessed at the rate printed on line 7 from the due date until the date the payment is received.

Verification and Audit. The records required to substantiate this return must be retained and be available for at least three

years following the date of filing the return.

Specific Instructions

Line 1. A qualified tire is any new pneumatic or solid tire, including take-off-tires, made of rubber or other resilient materials

that could be used on a motor vehicle, trailer, semitrailer, or farm tractor and delivered to a customer in Nebraska. New tires

sold specifically for vehicles (except for farm tractors) designed for off-road use, such as golf carts, all-terrain vehicles, or

farm discs, and recapped or regrooved tires are not qualified tires, and are not subject to the tire fee.

Enter the total number of qualified tires sold during this period.

Line 2. Enter the number of qualified tires delivered to purchasers who took possession of the tires outside Nebraska. This

includes sales of qualified tires sold to Native American Reservation Indians where title and possession are taken within the

boundaries of a Nebraska Indian Reservation. Out-of-state retailers will not use this line.

Line 3. Enter the number of qualified tires sold to the federal government or its agencies. The federal government and its

agencies are exempt from the tire fee.

Qualified tires sold to a state, county, or local government agency are subject to the tire fee.

Line 4. Enter the total number of new tires included on line 1 that were sold to another retailer for resale. You must have a

properly completed resale certificate,

Form

13, section A from each purchaser for which a deduction is claimed.

Line 7. A balance due or credit resulting from a partial payment, mathematical or clerical errors, penalty, or interest relating

to prior returns will be entered in this space by the Department. The amount of interest includes interest on any unpaid fee

through the due date of this return. If the amount due is paid before the due date, interest will be recomputed and a credit

will be given on your next return. If the amount entered has been satisfied by a previous remittance, it should be disregarded

when computing the amount to remit on line 8.

Line 8. Electronic payments may be made using any of the following options:

•

Department’s e-pay program (The State withdraws funds from your bank account based on the information

you provide);

•

ACH Credit (You work with your bank to deposit funds into the State’s bank account);

•

Nebraska Tele-pay (Pay by calling 800-232-0057); and

•

Credit card payments.

To find more information about these electronic payment options, see the Electronic Payment Options for State Taxes page

on the Department's website at Those not mandated to pay electronically may attach a check or money

order for the amount on line 3, made payable to the Nebraska Department of Revenue.

Authorized Signature. This return must be signed by the owner, partner, member, or corporate officer. If the taxpayer

Power of Attorney, Form

33, on file with the Department.

authorizes another person to sign this return, there must be a

Any person who is paid for preparing a taxpayer’s return must also sign the return as preparer.

1

1 2

2