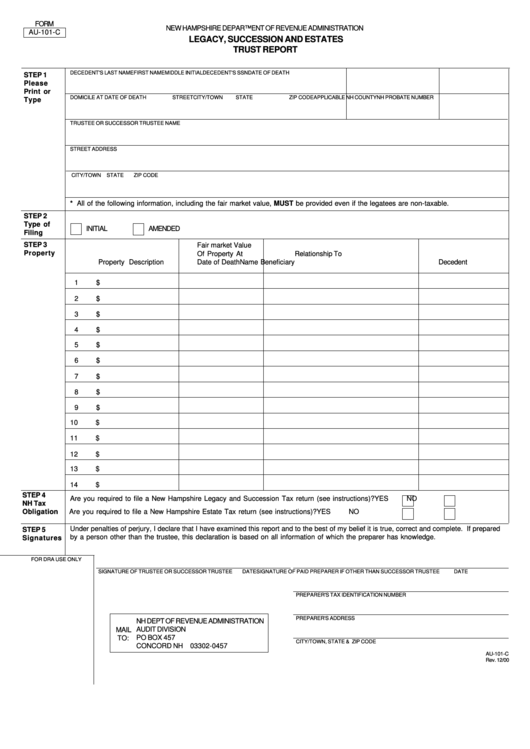

Form Au-101-C - Legacy, Succession And Estates Trust Report

ADVERTISEMENT

FORM

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

AU-101-C

LEGACY, SUCCESSION AND ESTATES

TRUST REPORT

DECEDENT'S LAST NAME

FIRST NAME

MIDDLE INITIAL

DECEDENT'S SSN

DATE OF DEATH

STEP 1

Please

Print or

DOMICILE AT DATE OF DEATH

STREET

CITY/TOWN

STATE

ZIP CODE

APPLICABLE NH COUNTY

NH PROBATE NUMBER

Type

TRUSTEE OR SUCCESSOR TRUSTEE NAME

STREET ADDRESS

CITY/TOWN

STATE

ZIP CODE

* All of the following information, including the fair market value, MUST be provided even if the legatees are non-taxable.

STEP 2

Type of

INITIAL

AMENDED

Filing

STEP 3

Fair market Value

Property

Of Property At

Relationship To

Property Description

Date of Death

Name Beneficiary

Decedent

1

$

2

$

3

$

4

$

5

$

6

$

7

$

8

$

9

$

10

$

11

$

12

$

13

$

14

$

STEP 4

Are you required to file a New Hampshire Legacy and Succession Tax return (see instructions)?

YES

NO

NH Tax

Are you required to file a New Hampshire Estate Tax return (see instructions)?

YES

NO

Obligation

Under penalties of perjury, I declare that I have examined this report and to the best of my belief it is true, correct and complete. If prepared

STEP 5

by a person other than the trustee, this declaration is based on all information of which the preparer has knowledge.

Signatures

FOR DRA USE ONLY

SIGNATURE OF TRUSTEE OR SUCCESSOR TRUSTEE

DATE

SIGNATURE OF PAID PREPARER IF OTHER THAN SUCCESSOR TRUSTEE

DATE

PREPARER'S TAX IDENTIFICATION NUMBER

PREPARER'S ADDRESS

NH DEPT OF REVENUE ADMINISTRATION

AUDIT DIVISION

MAIL

PO BOX 457

TO:

CITY/TOWN, STATE & ZIP CODE

CONCORD NH 03302-0457

AU-101-C

Rev. 12/00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2