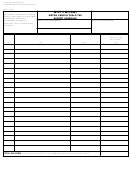

Form Ft-102b - Virginia Motor Vehicle Fuel Sales Tax Schedule Of Retailer Purchases For Resale Page 2

ADVERTISEMENT

Instructions for Filing Form FT-102

Schedule of Retailer Purchases for Resale

General:

Form FT-102B must be filed each month by every refiner, commission distributor, independent jobber or other

person who sells motor vehicle fuels within the cities of Alexandria, Falls Church, Fredericksburg, Manassas,

Manassas Park and Fairfax and the Counties of Arlington, Fairfax, Loudoun, Prince William and Stafford to

customers purchasing for resale. Anyone selling motor vehicle fuels exclusively to persons for resale is not

required to register and file Motor Vehicle Fuel Sales Tax Dealer Returns but must file Form FT-102B.

Note: Any refiner or other person who does not sell directly to motor vehicle fuel retailers but sells exclusively

to distributors who will resell the product to retailers is not required to file Form FT-102B.

Preparation of Form FT-102B:

1.

In Column 1, enter the name and address of each person (purchasing for resale) to whom motor vehicle

fuels were sold during the month in the cities of Alexandria, Falls Church, Fredericksburg, Manassas,

Manassas Park and Fairfax and the Counties of Arlington, Fairfax, Loudoun, Prince William and

Stafford. Do not report sales made to purchasers outside these localities or sales to persons claiming any

exemption other than the resale exemption.

2.

In Column 2, enter the purchaser’s motor vehicle fuel sales tax certificate of registration number. This

number may be found on the resale exemption certificate, Form ST-10, that was given by the purchaser

to claim exemption.

3.

In the heading of Column 3, indicate the unit of measure (gallons, liters, etc.) by which you sell the fuel.

In the remaining blanks, enter the total number of units sold to each purchaser during the period. Only

one entry is needed for each customer even though several purchases are made during the period. For

example, if you sold 1,000 gallons of diesel fuel, 2,000 gallons of regular gasoline and 5,000 gallons of

unleaded gasoline to a customer during a period, you would enter 8,000 in this column.

4.

In Column 4, enter the total amount for which the fuel was sold.

Method of Filing:

1.

Registered dealers should file this schedule with their Motor Vehicle Fuel Sales Tax Dealer Return,

Form FT- 102.

2.

Nonregistered dealers should mail this schedule to the Department of Taxation, P.O. Box 26627,

Richmond, Virginia 23261-6627, as soon as possible after the end of the month but not later

than the twentieth day of the following month.

If you have any questions about this schedule or need additional copies, please call (804) 367-8037 or write the

Department of Taxation, Office of Customer Services, P.O. Box 1115, Richmond, Virginia 23218. Tenemos

servicios disponible en Español.

6201151 - REV 10/07 - Page 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2