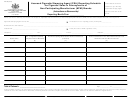

Schedule C1 (Cigarettes) Page 2

Download a blank fillable Schedule C1 (Cigarettes) in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Schedule C1 (Cigarettes) with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

Schedule C1 (Cigarettes) - Instructions

Washington Administrative Code 458-20-186 - Tax on cigarettes

(602) Reports and returns. The department may require any person dealing with cigarettes in this state to complete

and return forms, as furnished by the department, setting forth sales, inventory, and other data required by the

department to maintain control over trade in cigarettes.

(a) Manufacturers and wholesalers selling stamped, unstamped, or untaxed cigarettes must submit a complete

record of sales of cigarettes in this state monthly. This report is due no later than the fifteenth day of the calendar

month and must include all transactions occurring in the previous month.

Note: Filing of this report on interstate shipments into Washington may also satisfy the requirement of the federal

Jenkins Act.

Title 15, Chapter 10A, section 376, U.S. Code {commonly referred to as the “Jenkins Act”; recently amended by

the Prevent All Cigarette Trafficking (PACT) Act in 2010}

th

(a)(2) Not later than the 10

day of each calendar month, file with the tobacco tax administrator of the State into

which such shipment is made, a memorandum or a copy of the invoice covering each and every shipment of

cigarettes or smokeless tobacco made during the previous calendar month into such State; the memorandum or

invoice in each case to include the name and address of person to whom the shipment was made, the brand, and

the quantity thereof, and the name, address, and phone number of the person delivering the shipment to the

recipient on behalf of the delivery seller, with all invoice or memoranda information relating to specific

customers to be organized by city or town and by zip code.

For the full text of the PACT Act, click the following link:

Schedule C1 (Cigarettes) - STAMP CODES

S - Destination State, Stamp Affixed (Stamped)

U - Destination State, No Stamp Affixed (Unstamped)

E - Exempt Stamp Affixed (Allocation Sale to Washington Indian Tribe)

T - Tribal Stamp Affixed (Sale to Washington Compact Tribe)

C - Compact Stamp Affixed (Sale to Washington Compact Tribe)

O - Out-of-State Indian Tribal Stamp Affixed (Stamped)

Submitting a report in an alternative format

If you wish to submit your report in an alternative format, or if you have any other questions, please call the Special

Programs Division, Department of Revenue, at 360-570-3265, option 3.

For tax assistance or to request this document in an alternate format, visit or call 1-800-647-7706. Teletype (TTY) users may

call (360) 705-6718.

REV 82 2103e-C1 (10/28/10)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2