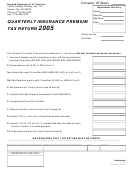

Form Pt-200 - Quarterly Petroleum Business Tax Return Page 2

ADVERTISEMENT

Instructions

Page 2 of 2 PT-200 (11/15)

General information

Fee for payments returned by banks – The law allows the Tax

Department to charge a $50 fee when a check, money order, or

You must file Form PT-200, Quarterly Petroleum Business Tax Return,

electronic payment is returned by a bank for nonpayment. However, if

for each quarterly period. Monthly filers must use Form PT-100,

an electronic payment is returned as a result of an error by the bank or

Petroleum Business Tax Return, and Form PT-106, Retailers of

the department, the department won’t charge the fee. If your payment

Non-Highway Diesel Motor Fuel Only, or PT-104, Tax on Kero-Jet Fuel.

is returned, we will send a separate bill for $50 for each return or other

tax document associated with the returned payment.

If you do not receive the proper forms covering a tax you owe, see

Need help? for information on how to obtain forms.

Mail to: NYS Tax Department, PO Box 1833, Albany NY 12201-1833.

All retailers of non-highway diesel motor fuel only and distributors

If you are using a private delivery service, see Publication 55,

of kero-jet fuel only who are not required to be registered as

Designated Private Delivery Services.

distributors of motor fuel, distributors of diesel motor fuel, residual

petroleum product businesses, or liquefied petroleum gas fuel

Lines 10 and 11 – If line 9 shows an overpayment, enter on line 10

permittees must file Form PT-200. This return recaps the amount

the amount you want to take as a credit on line 4 of your next quarterly

of the various taxes computed on Forms PT-201, Retailers of

return. Enter on line 11 the amount that should be refunded to you.

Non-Highway Diesel Motor Fuel Only (Quarterly Filer), and PT-202,

Sales tax exempt organizations – If you are a sales tax

Tax on Kero-Jet Fuel (Quarterly Filer), and determines the total

exempt organization that has established its status as an exempt

amount due, including any appropriate penalty and interest.

organization under Tax Law section 1116(a), and all diesel motor

Change of business information — Enter your legal name and

fuel that you import into New York State is consumed exclusively by

complete mailing address if they are not preprinted on the form. If

you, then you are not subject to the petroleum business tax. Mark

the printed information needs to be changed, make corrections on

an X in the appropriate box on the front of the return and do not

the form and either select the option to change your address on our

include any petroleum business tax (Article 13-A) in the amounts on

Web site (see Need help?), or submit Form DTF-95, Business Tax

Form PT-201 or PT-202.

Account Update. If only your address needs to be changed, you can

submit Form DTF-96, Report of Address Change for Business Tax

Signature

Accounts, instead of Form DTF-95. You can get these forms from

The return must be signed and dated by the owner (if an individual),

our Web site or by phone; or call the Miscellaneous Tax Information

a partner (if a partnership), or by the president, treasurer, chief

Center for assistance (see Need help?).

accounting officer, or any other person authorized to act on behalf of

the corporation (if a corporation). The fact that an individual’s name

Line instructions

is signed on the certification shall be prima facie evidence that the

Lines 1 and 2

individual is authorized to sign and certify the report on behalf of the

business.

Type of filer – Indicate the type of petroleum product you are

Additionally, if anyone other than an employee, owner, partner, or officer

registered for by marking an X in the appropriate box in the left-hand

column on the front of the return.

of the business is paid to prepare the return, he or she is required to

sign and date the return and provide his or her mailing address and

You must attach the appropriate Form PT-201 or PT-202 for the box

e-mail address.

marked. Enter any credit amounts in brackets.

Paid preparer’s responsibilities – Under the law, all paid

Line 1 – Enter the amount from Form PT-201, line 28.

preparers must sign and complete the paid preparer section. Paid

Line 2 – Enter the amount from Form PT-202, line 17.

preparers may be subject to civil and/or criminal sanctions if they fail

to complete this section in full.

Line 3 – Enter the amount from line 1 or 2.

When completing this section, you must enter your New York tax

Line 4 – Enter the total credit from line 10 of your prior quarterly

preparer registration identification number (NYTPRIN) if you are

Form PT-200.

required to have one. Also, you must enter your federal preparer tax

identification number (PTIN) if you have one; if not, you must enter

Line 5 – If, after applying the credit from line 4 to the amount on

your social security number.

line 3, the result is an amount greater than zero, enter the balance

due. If the result is zero or less than zero (negative amount), enter 0

Need help?

and show the overpayment on line 9.

Line 6 – Penalties – A penalty is imposed at the rate of 10% of

the tax due for the first month or part of a month and 1% of the tax

Visit our Web site at

due for each subsequent month or part of a month in which the tax

(for information, forms, and online services)

remains unpaid, up to a maximum penalty of 30%.

Miscellaneous Tax Information Center:

(518) 457-5735

If a return is not filed within 60 days of the due date, the penalty will

be determined as indicated above but will not be less than the lesser

To order forms and publications:

(518) 457-5431

of $100 or 100% of the tax due. In addition, failure to file returns and

pay any tax due may result in criminal penalties under the Tax Law

Text Telephone (TTY) Hotline

Article 37.

(for persons with hearing and

speech disabilities using a TTY):

(518) 485-5082

Line 7 – Interest – Interest is computed at the rate set by the

Commissioner of Taxation and Finance and is compounded daily.

Privacy notification

It is computed from the day the tax was due until the day the tax is

paid. Interest is a charge for the use of state funds and may not be

New York State Law requires all government agencies that maintain

waived.

a system of records to provide notification of the legal authority

for any request, the principal purpose(s) for which the information

Note: You may compute your penalty and interest by accessing

is to be collected, and where it will be maintained. To view this

our Web site, or you may call and we will compute the penalty and

information, visit our Web site, or, if you do not have Internet access,

interest for you (see Need help?).

call and request Publication 54, Privacy Notification. See Need

Line 8 – Attach a check or money order payable in U.S. funds for

help? for the Web address and telephone number.

the total amount due on line 8 to Commissioner of Taxation and

Finance.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2