State of New Mexico Taxation and Revenue Department

RPD-41369 2014

2014 New Mexico Net Operating Loss Carryforward Schedule for Personal Income Tax Instructions

Rev. 02/05/2015

Page 1 of 3

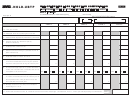

2 using the information from your 2014 PIT-1 return. Transfer the amount

About the New Mexico Net Operating Loss (NM NOL)

from Worksheet 2, line 6 to the NM NOL Carryforward Schedule, Column

All NM NOLs must flow from a federal net operating loss. You cannot have

3, row 1. For any other year, leave this column blank.

a NM NOL without first having a federal net operating loss.

Column 4. Loss Used. Enter that portion of the NM NOL incurred (Col-

Unlike a federal net operating loss, a NM NOL incurred in tax years after

umn 2) that you used during tax year 2014. The total of Column 4, line

January 1, 2013, cannot be carried back. They may be carried forward for

1 must be equal to Worksheet 2, line 8, and may not exceed the current

19 years after the tax year to which the exclusion first applies or until the

year NM net income before NM NOL carryforward shown in Column 3,

total amount of the loss carryover has been used, whichever occurs first.

row 1. This is your excludable NM NOL used in the current tax year. This

amount must match the amount you entered on Schedule PIT-ADJ, line

A NM NOL incurred in tax years after 1990, but before December 31, 2012,

7, New Mexico net operating loss.

also cannot be carried back. However, it may only be carried forward for

five years or until the total amount of the loss carryover has been used,

Column 5. Year Loss Applied. Use the year columns to record how you

whichever occurs first.

applied a prior-year NM NOL. Under the column year for each prior-year

NM NOL you incurred, show the loss and the amount of NM NOL you ap-

The first year you can apply a NM NOL is:

plied.

• If you filed your return on time, you can apply it the following tax year,

Column 6. NM NOL Expired. Enter the amount of NM NOL that expires

or

in the current year because the balance of the remaining NM NOL cannot

• You can apply it the first tax year that begins after the date you file a

be carried forward for more than 5 years, or for NM NOLs incurred after

return establishing the loss.

December 31, 2012, for more than 19 years. See About the New Mexico

Net Operating Loss (NM NOL) in the previous column for more details.

Instructions for Completing the NM NOL Carryforward

Schedule

Column 7. NOL Carryforward Available for Next Year. Enter the amount

of NM NOL that will be available for carryforward the next year. From the

Column 1. Tax Year. Enter the tax year when you incurred a NM NOL to

NM NOL you incurred and reported in Column 2, subtract the amounts

which a NM NOL carryforward is available to use in the current year. Row

included in Columns 4, 5, and 6.

1 includes only information for the 2014 tax year. Use subsequent rows

for prior-year NM NOLs.

Column 2. Net Operating Loss Incurred. Enter the amount of NM NOL

you incurred during the year in Column 1. Use Worksheet 1 to determine

the amount of NM NOL incurred in the tax year of the loss. When complet-

ing Worksheet 1, use the information from the PIT-1 tax return you filed for

the year you incurred the NM NOL.

Column 3. 2014 NM Net Income Before NM NOL. Enter the 2014 NM

net income before applying any NM NOL deduction. Complete Worksheet

1

1 2

2 3

3 4

4