State of New Mexico Taxation and Revenue Department

RPD-41369 2014

2014 New Mexico Net Operating Loss Carryforward Schedule for Personal Income Tax Instructions

Rev. 02/05/2015

Page 3 of 3

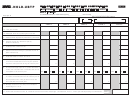

Example

In tax year 2014, taxpayer X has tax due and wants to carryforward prior-year losses to offset the income on X’s 2014 personal income tax return. X

incurred an NM NOL of $48,000 in 2009, and an NM NOL of $97,000 in 2010. In tax years 2011, 2012, and 2013, X calculated the current year net

income before applying NM NOL at $7,000, $1,500 and $2,500, respectively. X applied the NM NOL incurred in tax year 2009 towards the net income

for tax years 2011, 2012, and 2013. For current tax year 2014, the net taxable income that X calculates before NM NOL is $8,000. X may use the

loss incurred in 2009 towards X’s 2014 net income. Because X cannot carry forward the balance from the 2009 NM NOL for more than five years, X

reports in Column 6 the amount of NM NOL that expires during 2014, which X cannot exclude from NM net income during 2015. X completes Form

RPD-41369 as shown here.

Col. 1

Col. 2

Col. 3

Col. 4

Col. 5

Col. 6

Col. 7

Tax Year

Net Operating

2014 NM

2014

Year Loss Applied

NM NOL

NM NOL

Loss Incurred

Net Income Before

Loss Used

If you applied the NM NOL reported in Column 2 in previous years, enter

Expired

Carryforward

in the year in

NM NOL

the amount in the column corresponding to the year when you applied it.

Available for

The sum of Column 4

Column 1

from

cannot be greater

Next Year

Worksheet 2, line 7

than Column 3 for

2013

2012

2011

2010

2009

tax year 2014.

8,000

2014

2010

97,000

97,000

29,000

0

2009

48,000

8,000

2,500

1,500

7,000

Line 1 must equal Worksheet 2, line 9.

Line 1. Loss used during 2014 tax year.

8,000

Enter the sum of Column 4.

Also enter this amount on Schedule PIT-ADJ, line 7.

1

1 2

2 3

3 4

4