State of New Mexico Taxation and Revenue Department

RPD-41369 2014

2014 New Mexico Net Operating Loss Carryforward Schedule for Personal Income Tax Instructions

Rev. 02/05/2015

Page 2 of 3

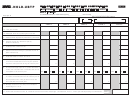

Worksheet 1. For Column 2 of the Carryforward Schedule

to compute NM NOL incurred in prior years

Line 1. Federal NOL as defined by Section 172(c) of the Internal Revenue Service for the tax year of the loss.

Line 2. Interest received on U.S. Government obligations less related expenses and reported on the New Mexico

tax return for the tax year. This amount is reported on Schedule PIT-ADJ in the tax year of the loss.

Line 3. Enter the sum of lines 1 and 2. This is the NM NOL loss incurred in the year of the loss that you report in

Column 2 of the Carryforward Schedule.

Worksheet 2. For Columns 3 and 4 of the Carryforward Schedule

to compute net income before the current year NM NOL deduction is applied

Use the information on your 2014 PIT-1 and 2014 PIT-ADJ for the entries below.

1.

Enter the federal adjusted gross income reported on Form 2014 PIT-1, line 9.

2.

+

+

Enter the amount of state and local income tax deduction reported on Form 2014 PIT-1, Line 10.

3.

+

Enter the additions to federal adusted gross income from Form 2014 PIT-1, line 11.

+

4.

-

-

Enter the standard or itemized deduction amount reported on Form 2014 PIT-1, line 12.

5.

-

-

Enter the federal exemption amount reported on Form 2014 PIT-1, line 13.

6.

-

Enter the taxable refunds, credits, or offsets of state and local income taxes, reported on Schedule

-

2014 PIT-ADJ, line 20.

7.

=

Enter the sum of lines 1, 2, and 3, less the sum of lines 4 through 6, but not below zero. This is

=

the net income before applying the NM NOL. Enter in Column 3 of the Carryforward Schedule.

8.

Enter the sum of prior-year NM NOL carryforward available.

+

9.

Enter the lesser of lines 7 and 8. This is the excludable NM NOL carryforward amount. Also enter

=

this amount in line 1 at the bottom of Column 4.

1

1 2

2 3

3 4

4