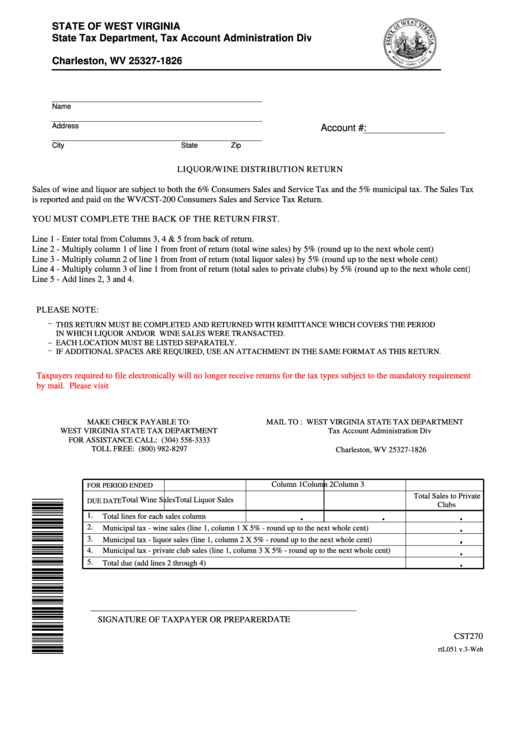

STATE OF WEST VIRGINIA

State Tax Department, Tax Account Administration Div

P.O. Box 1826

Charleston, WV 25327-1826

Name

Address

Account #:

City

State

Zip

LIQUOR/WINE DISTRIBUTION RETURN

Sales of wine and liquor are subject to both the 6% Consumers Sales and Service Tax and the 5% municipal tax. The Sales Tax

is reported and paid on the WV/CST-200 Consumers Sales and Service Tax Return.

YOU MUST COMPLETE THE BACK OF THE RETURN FIRST.

Line 1 - Enter total from Columns 3, 4 & 5 from back of return.

Line 2 - Multiply column 1 of line 1 from front of return (total wine sales) by 5% (round up to the next whole cent).

Line 3 - Multiply column 2 of line 1 from front of return (total liquor sales) by 5% (round up to the next whole cent).

Line 4 - Multiply column 3 of line 1 from front of return (total sales to private clubs) by 5% (round up to the next whole cent).

Line 5 - Add lines 2, 3 and 4.

PLEASE NOTE:

THIS RETURN MUST BE COMPLETED AND RETURNED WITH REMITTANCE WHICH COVERS THE PERIOD

IN WHICH LIQUOR AND/OR WINE SALES WERE TRANSACTED.

EACH LOCATION MUST BE LISTED SEPARATELY.

IF ADDITIONAL SPACES ARE REQUIRED, USE AN ATTACHMENT IN THE SAME FORMAT AS THIS RETURN.

Taxpayers required to file electronically will no longer receive returns for the tax types subject to the mandatory requirement

by mail. Please visit for additional information.

MAKE CHECK PAYABLE TO:

MAIL TO : WEST VIRGINIA STATE TAX DEPARTMENT

WEST VIRGINIA STATE TAX DEPARTMENT

Tax Account Administration Div

FOR ASSISTANCE CALL: (304) 558-3333

P.O. Box 1826

TOLL FREE: (800) 982-8297

Charleston, WV 25327-1826

Column 1

Column 2

Column 3

FOR PERIOD ENDED

Total Sales to Private

Total Wine Sales

Total Liquor Sales

DUE DATE

Clubs

1.

Total lines for each sales column

2.

Municipal tax - wine sales (line 1, column 1 X 5% - round up to the next whole cent)

3.

Municipal tax - liquor sales (line 1, column 2 X 5% - round up to the next whole cent)

4.

Municipal tax - private club sales (line 1, column 3 X 5% - round up to the next whole cent)

5.

Total due (add lines 2 through 4)

SIGNATURE OF TAXPAYER OR PREPARER

DATE

CST270

rtL051 v.3-Web

1

1 2

2