Form Alc 105 - Wine Tax Return

Download a blank fillable Form Alc 105 - Wine Tax Return in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form Alc 105 - Wine Tax Return with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

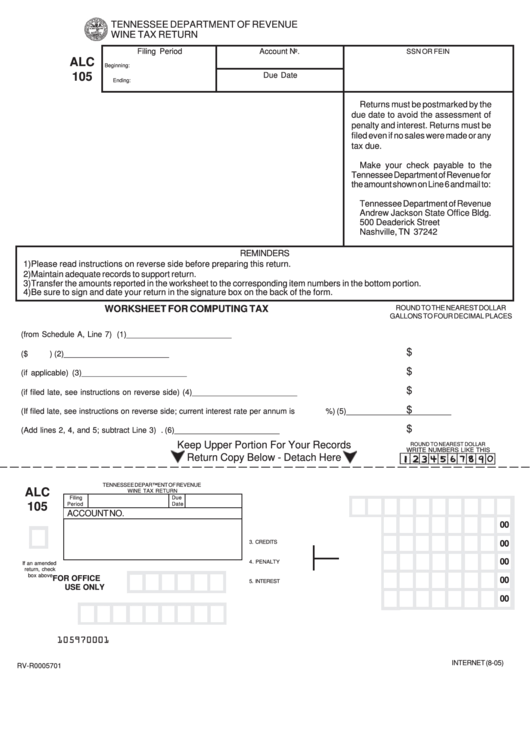

TENNESSEE DEPARTMENT OF REVENUE

WINE TAX RETURN

Account No.

Filing Period

SSN OR FEIN

ALC

Beginning:

105

Due Date

Ending:

Returns must be postmarked by the

due date to avoid the assessment of

penalty and interest. Returns must be

filed even if no sales were made or any

tax due.

Make your check payable to the

Tennessee Department of Revenue for

the amount shown on Line 6 and mail to:

Tennessee Department of Revenue

Andrew Jackson State Office Bldg.

500 Deaderick Street

Nashville, TN 37242

REMINDERS

1) Please read instructions on reverse side before preparing this return.

2) Maintain adequate records to support return.

3) Transfer the amounts reported in the worksheet to the corresponding item numbers in the bottom portion.

4) Be sure to sign and date your return in the signature box on the back of the form.

WORKSHEET FOR COMPUTING TAX

ROUND TO THE NEAREST DOLLAR

GALLONS TO FOUR DECIMAL PLACES

1. Taxable sales in gallons (from Schedule A, Line 7) .................................................................................. (1)

________________________

$

2. Tax due - Multiply Line 1 by the tax rate ($

) ........................................................................................ (2)

________________________

$

3. Credits (if applicable) .................................................................................................................................. (3)

________________________

$

4. Penalty (if filed late, see instructions on reverse side) .............................................................................. (4)

________________________

$

5. Interest (If filed late, see instructions on reverse side; current interest rate per annum is

%) ...... (5)

________________________

$

6. Total remittance amount (Add lines 2, 4, and 5; subtract Line 3) .............................................................. (6)

________________________

Keep Upper Portion For Your Records

ROUND TO NEAREST DOLLAR

WRITE NUMBERS LIKE THIS

Return Copy Below - Detach Here

TENNESSEE DEPARTMENT OF REVENUE

ALC

WINE TAX RETURN

Filing

Due

1. TAXABLE SALES IN GALLONS

105

Period

Date

ACCOUNT NO.

2. TAX DUE

00

3. CREDITS

00

00

4. PENALTY

If an amended

return, check

box above

FOR OFFICE

00

5. INTEREST

USE ONLY

00

6. TOTAL AMOUNT REMITTED

105970001

INTERNET (8-05)

RV-R0005701

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2