-

-

-

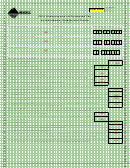

Form EST-I, Page 2

SSN

FEIN

Part III. Regular Method. Use this method if you made payments of unequal amounts. The due dates shown are for calendar year

taxpayers. Adjust these dates accordingly for fi scal year returns.

A

B

C

D

Complete lines 14 through 17 in each column before going to line 18.

4/15/13

6/17/13

9/16/13

1/15/14

14. Required quarterly payment. Divide line 6 from page 1 by

four (4) and enter the result in each column ........................... 14.

15. Add lines 3a and 3b from page 1 and enter one-fourth of the

amount in each column .......................................................... 15.

16. Subtract line 15 from line 14 ................................................... 16.

17. Enter the amount of estimated tax paid by each date.

(Include the amount from line 3c on page 1 in column A.) ..... 17.

Complete lines 18 through 24 of one column before going to the next column.

18. Overpayment from previous quarter. Enter the amount, if

any, from line 24 of the previous column ................................ 18.

19. Estimated payments for the quarter. Add lines 17 and 18 ...... 19.

20. Total underpayment to date. Add the amounts from lines 22

and 23 of the previous column and enter the result ............... 20.

21. Subtract line 20 from line 19. If zero or less, enter zero ......... 21.

22. Underpayment from previous quarters. If the amount on

line 21 is zero, subtract line 19 from line 20. Otherwise,

enter zero ............................................................................... 22.

23. Current quarter underpayment. If line 21 is equal to or less

than line 16, subtract line 21 from line 16 and enter the result.

If line 21 is greater than line 16, go to line 24 ......................... 23.

24. Overpayment. If line 16 is less than line 21, subtract line

16 from line 21 and enter the result. Then go to line 18, next

column .................................................................................... 24.

Complete lines 25 through 27 of the columns where there is an amount on line 23.

25. Enter the date(s) you paid the amount on line 23 or the 15th

day of the fourth month after the close of the tax year,

whichever is earlier (see instructions) .................................... 25.

26. Enter the number of days from the installment due date to the

date shown on line 25 (see instructions) ................................ 26.

27. Interest. Multiply line 23 x days from

line 26 x 8% / 365 days .......................................................... 27.

28. Interest on Underpayment of Estimated Tax. Add the amounts on line 27 of each column. Enter total here

and on Form 2, line 66; Form 2M, line 57; Form 2EZ, line 17; or Form FID-3, line 46 ...........................................28. $

2013 Montana Individual and Fiduciary Income Tax Table

If Your Taxable

Multiply

If Your Taxable

Multiply

But Not

And

This Is

But Not

And

This Is

Income Is

Your Taxable

Income Is

Your Taxable

More Than

Subtract

Your Tax

More Than

Subtract

Your Tax

More Than

Income By

More Than

Income By

$0

$2,800

1% (0.010)

$0

$10,100

$13,000

5% (0.050)

$252

$2,800

$4,900

2% (0.020)

$28

$13,000

$16,700

6% (0.060)

$382

$4,900

$7,400

3% (0.030)

$77

More Than $16,700

6.9% (0.069)

$532

$7,400

$10,100

4% (0.040)

$151

For example:

Taxable income $6,800 X 3% (0.030) = $204.

$204 minus $77 = $127 tax

If you fi le your Montana tax return electronically, you do not need to mail this form to us unless we ask you for a copy. When you fi le electronically, you

represent that you have retained the required documents in your tax records and will provide them upon the department’s request.

*13DC0201*

*13DC0201*

1

1 2

2 3

3 4

4 5

5 6

6 7

7