1

1

2

1 2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

84

85

3

3

4

4

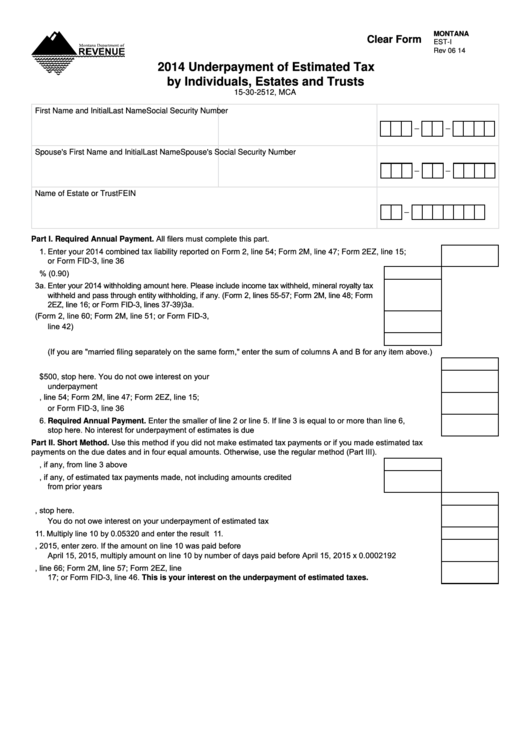

MONTANA

Clear Form

est-I

5

5

Rev 06 14

6

6

7

7

2014 Underpayment of Estimated Tax

8

8

by Individuals, Estates and Trusts

9

9

15-30-2512, MCA

10

10

11

11

First Name and Initial

Last Name

social security Number

12

12

13

13

110

-

-

X X X X X X X X X

100

14

14

15

15

spouse's First Name and Initial

Last Name

spouse's social security Number

16

16

17

17

120

130

-

-

18

18

19

19

Name of estate or trust

FeIN

20

20

140

21

21

150

-

X X X X X X X X X

22

22

23

23

Part I. Required Annual Payment. All filers must complete this part.

24

24

1. enter your 2014 combined tax liability reported on Form 2, line 54; Form 2M, line 47; Form 2eZ, line 15;

25

25

160

or Form FID-3, line 36 ..............................................................................................................................................1.

26

26

27

2. Multiply line 1 by 90% (0.90) ......................................................................................................... 2.

27

170

28

28

3a. Enter your 2014 withholding amount here. Please include income tax withheld, mineral royalty tax

29

29

withheld and pass through entity withholding, if any. (Form 2, lines 55-57; Form 2M, line 48; Form

180

30

30

2EZ, line 16; or Form FID-3, lines 37-39) ...........................................................................................3a.

31

31

3b. Enter your 2014 refundable credits here (Form 2, line 60; Form 2M, line 51; or Form FID-3,

32

32

190

line 42) ......................................................................................................................................... 3b.

33

33

200

3c. Enter your amount credited from your 2013 overpayment here ...................................................3c.

34

34

(If you are "married filing separately on the same form," enter the sum of columns A and B for any item above.)

35

35

210

3. Add lines 3a through 3c and enter the result here....................................................................................................3.

36

36

37

4. Subtract line 3 from line 1. If your result is less than $500, stop here. You do not owe interest on your

37

38

38

underpayment...........................................................................................................................................................4.

220

39

39

5. Enter the 2013 combined total tax liability reported on Form 2, line 54; Form 2M, line 47; Form 2EZ, line 15;

230

40

or Form FID-3, line 36 ..............................................................................................................................................5.

40

41

41

6. Required Annual Payment. Enter the smaller of line 2 or line 5. If line 3 is equal to or more than line 6,

240

42

42

stop here. No interest for underpayment of estimates is due ...................................................................................6.

43

43

Part II. Short Method. Use this method if you did not make estimated tax payments or if you made estimated tax

44

44

payments on the due dates and in four equal amounts. Otherwise, use the regular method (Part III).

45

45

250

7. Enter the amount, if any, from line 3 above ................................................................................... 7.

46

46

8. Enter the total amount, if any, of estimated tax payments made, not including amounts credited

47

47

from prior years ..................................................................................................................................8.

260

48

48

270

9. Add lines 7 and 8 ......................................................................................................................................................9.

49

49

280

50

10. Subtract line 9 from line 6. This is your total underpayment for 2014. If the result is zero or less, stop here.

50

You do not owe interest on your underpayment of estimated tax ...........................................................................10.

51

51

52

52

11. Multiply line 10 by 0.05320 and enter the result ..................................................................................................... 11.

290

53

53

12. If the amount on line 10 was paid on or after April 15, 2015, enter zero. If the amount on line 10 was paid before

300

54

54

April 15, 2015, multiply amount on line 10 by number of days paid before April 15, 2015 x 0.0002192 ................12.

55

55

13. Subtract line 12 from line 11 and enter the result here and on Form 2, line 66; Form 2M, line 57; Form 2EZ, line

310

56

56

17; or Form FID-3, line 46. This is your interest on the underpayment of estimated taxes. ...........................13.

57

57

58

58

59

59

60

60

61

61

62

62

63

63

64

64

65

1

2

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84 85

66

66

1

1 2

2 3

3 4

4 5

5 6

6 7

7