Form EST-I, Page 7

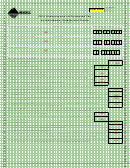

Example 5.

Assume the same facts as in Example 3. On line 27, enter the interest for each underpayment: “6.58” ($2,000 × (15 ×

0.08 ÷ 365)) and “$27.62” ($2,000 × (63 × 0.08 ÷ 365)). The entries are illustrated below.

A

B

C

D

4/15/13

6/17/13

9/16/13

1/15/14

25. Enter the date(s) you paid the amount on line 23 or the 15th

4/30/13

day of the fourth month after the close of the tax year,

whichever is earlier (see instructions) .................................... 25.

6/17/13

26. Enter the number of days from the installment due date to the

15

date shown on line 25 (see instructions) ................................ 26.

63

27. Interest. Multiply line 23 x days from

6.58

line 26 x 8% / 365 days .......................................................... 27.

27.62

because they are cumulative. For example, column B will

Part IV. Annualized Income Installment Method

include the amount from column A as well as your itemized

If your income varied during the year because, for example,

deductions from 4/1/13 through 5/31/13.

you operated your business on a seasonal basis or had

Estates and trusts will need to enter zero and continue to

a large capital gain late in the year, you may be able to

line 37. Enter the amount from line 31 on line 37.

lower or eliminate the amount of one or more required

installments by using the annualized income installment

Line 35. Enter the full amount of your standard deduction.

method. Use Part IV to fi gure the required installments to

This is 20% (0.20) of line 31, but if your fi ling status is:

enter on line 14 of Part III.

● Single or married fi ling separately, do not enter less

If you use Part IV for any payment due date, you must use

than $1,900 or more than $4,270, or

it for all payment due dates.

● Married fi ling jointly or head of household, do not enter

To use the annualized income installment method to fi gure

less than $3,800 or more than $8,540.

interest on the underpayment of estimated tax payments,

Line 38. For each column, multiply $2,280 by your total

you must do all of the following:

exemptions. Your total exemptions can be found on your

1. Complete Part IV, lines 29 through 53. Enter the

2013 Form 2, line 6d or Form 2M, line 5d. If you fi led Form

amounts from Part IV, line 53, columns A through D, in

2EZ in 2013, enter $2,280 if your fi ling status was single, or

the corresponding columns of Part III, line 14.

$4,560 if your fi ling status was married fi ling jointly.

2. Complete Part III to fi gure the interest.

Estates and trusts will need to enter $2,280 on this line.

To fi gure the amount of each required installment, Part IV

Line 40. To compute the tax, use the 2013 Montana

selects the smaller of the annualized income installment

Individual Income Tax Table located at the bottom of Form

or the regular installment (that has been increased by the

EST-I, page 2.

amount saved by using the annualized income installment

Line 41. If net capital gains are included in your Montana

method in fi guring any earlier installments).

adjusted gross income reported on line 29, multiply the net

Line 29. For each period (column), fi gure your Montana

capital gains amount by 2% (0.02) and enter the result on

adjusted gross income. Include your share of partnership

this line.

or S corporation income or loss items for the period.

Line 43. Enter your nonrefundable tax credits for each

Please note that each column will include the amount from

period. For a complete list and description of Montana

the previous column because they are cumulative. For

nonrefundable tax credits, please see Form 2, Schedule V

example, column B will include the amount from column A

and Form 2 instructions.

as well as your Montana adjusted gross income from 4/1/13

Line 53. Enter the smaller of line 48 or line 51. You will also

through 5/31/13.

need to enter this amount on line 14 of Part III and continue

Line 30. Estates and trusts do not use the amounts shown

through the calculations of Part III to calculate the interest

in columns A through D. Instead, use 6, 3, 1.71429, and

on the underpayment of estimated tax.

1.09091, respectively, as the annualization amounts.

Administrative Rules of Montana: 42.17.304 through

Line 32. Enter your itemized deductions for each period.

42.17.317

If you do not itemize deductions, enter zero in columns A

Questions? Please call us toll free at (866) 859-2254 (in

through D and continue to line 35. Please note that each

Helena, 444-6900).

column will include the amount from the previous column

1

1 2

2 3

3 4

4 5

5 6

6 7

7