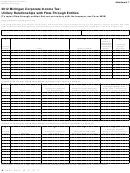

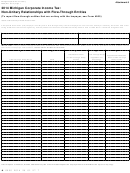

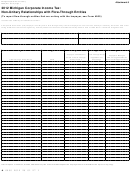

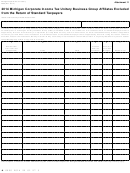

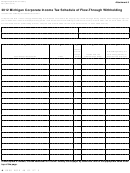

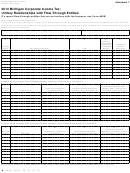

Form 4900 - Michigan Corporate Income Tax - Unitary Relationships With Flow-Through Entities - 2014 Page 3

ADVERTISEMENT

Instructions for Form 4900

Michigan Corporate Income Tax:

Unitary Relationships with Flow-Through Entities

operating entities) that are corporations, financial institutions

Purpose

or insurance companies that satisfy the control test and have

made the election to file as a UBG. Once the election is made,

To assist in calculating the apportionment factor of a taxpayer

that is unitary with one or more flow-through entities.

the Affiliated Group is treated as a UBG for all purposes.

For more information regarding the control and relationship

General Instructions

test, see the Treasury Web site at

This form is intended to only be used by a Corporate Income

and go to the “Withholding” section.

Tax (CIT) taxpayer that is unitary with one or more flow-

If the taxpayer is a UBG, fill out this form at the group level.

through entities. Included in this form will be flow-through

Specifically, as noted in the Column by Column Instructions,

entities that are unitary with the taxpayer and whose tax year

columns E must be filled out using data from the group as a

ends with or within the tax year included on the taxpayer’s CIT

whole.

Annual Return (Form 4891).

To determine whether the taxpayer and the flow-through entity

A flow-through entity is an entity that, for the applicable tax

satisfy the second requirement to be unitary with one another

year, is treated as a subchapter S Corporation under section

– that they satisfy either the Flow-of-Value or Integration Test

1362(a) of the internal revenue code, a general partnership, a

– apply the same concepts as used when determining whether

trust, a limited partnership, a limited liability partnership, or a

a UBG satisfies the Relationship Test as explained on the

limited liability company that is not taxed as a C Corporation

Treasury Web site at .

for federal income tax purposes.

NOTE: A flow-through entity owned directly or indirectly by

A taxpayer is unitary with a flow-through entity if the taxpayer:

a taxpayer may or may not be unitary with that taxpayer. This

• Owns or controls, directly or indirectly, more than 50% of

form asks for information only on the flow-through entities that

the ownership interests with voting rights (or ownership

are unitary with the taxpayer. For those flow-through entities

that are not unitary with the taxpayer, use the Non-Unitary

interests that confer comparable rights to voting rights) of

the flow-through entity; AND

Relationships with Flow-Through Entities (Form 4898).

• The taxpayer and flow-through entity have activities or

operations which result in a flow of value between the

Column-by-Column Instructions

taxpayer and the flow-through entity, or between the flow-

Columns not listed are explained on the form.

through entity and another flow-through entity unitary with

Name and Account Number: Enter the name and Federal

the taxpayer, or has business activities or operations that are

Employer Identification Number (FEIN) of the taxpayer as

integrated with, are dependant upon, or contribute to each

reported on page 1 of Form 4891.

other.

The determination of whether a taxpayer is unitary with a flow-

UBGs: Complete one Form 4900 for the entire group, and use

through entity is made at the taxpayer level. If the taxpayer

multiple copies of the form if reporting information on more

flow-through entities than space allows. Enter the Designated

at issue is a Unitary Business Group (UBG), the ownership

Member name in the Taxpayer Name field and the Designated

requirement will be made at the UBG level. Thus, if the

combined ownership of the flow-through entity by the UBG

Member’s Federal Employer Identification Number in the FEIN

box.

is greater than 50%, then the ownership requirement will be

satisfied.

Column A: In Column A, assign a number (beginning with

NOTE: PA 266 of 2013 authorizes an affiliated group

1 and numbering sequentially) to all flow-through entities

election that applies an alternate test for finding a unitary

that are unitary with the taxpayer. This same number must

relationship between corporations. This act DID NOT create

also be used in Columns F and K when referencing the same

a corresponding “affiliated group” test for finding a unitary

flow-through entity. (If using multiple copies of the form

relationship between a corporation and an FTE. The existence

the subsequent forms numbering should start with the next

of a unitary relationship between a corporation and an FTE is

sequential number from the previous completed form)

still based exclusively on the traditional two-part test described

Columns B and C: Identify each flow-through entity by name

above.

and FEIN.

A UBG is a group of United States C Corporations, insurance

Column D: Check this box if the flow-through entity has

companies, and financial institutions, other than a foreign

receipts from transportation services. To calculate Sales from

operating entity, that satisfies the control test and relationship

Transportation Services, see the instructions for Columns

test. If an Affiliated Group Election is made (see instructions

G and L and the table in the “Sourcing of Sales to Michigan”

for Form 4891), the UBG also includes all members of the

section of Form 4891.

affiliated group, as defined in IRC 1504 except that the group

Column E: Enter on this line the percentage of this flow-

includes only US persons (no foreign persons or foreign

69

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5