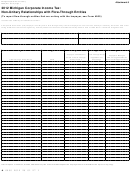

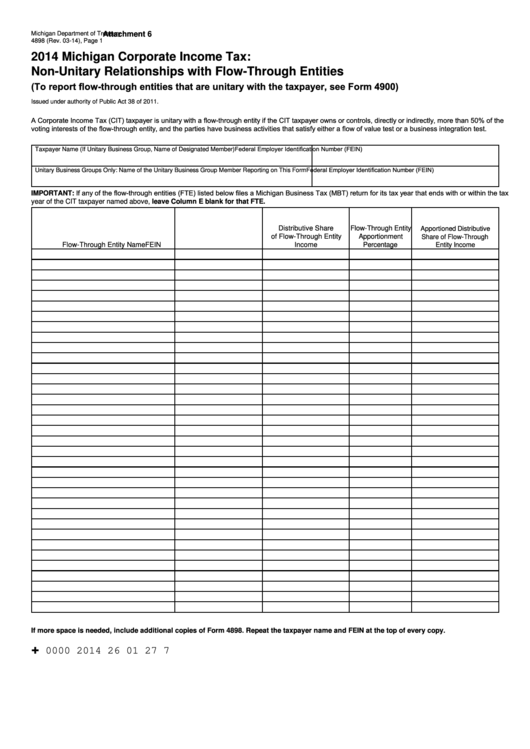

Form 4898 - Michigan Corporate Income Tax: Non-Unitary Relationships With Flow-Through Entities - 2014

ADVERTISEMENT

Michigan Department of Treasury

Attachment 6

4898 (Rev. 03-14), Page 1

2014 Michigan Corporate Income Tax:

Non-Unitary Relationships with Flow-Through Entities

(To report flow-through entities that are unitary with the taxpayer, see Form 4900)

Issued under authority of Public Act 38 of 2011.

A Corporate Income Tax (CIT) taxpayer is unitary with a flow-through entity if the CIT taxpayer owns or controls, directly or indirectly, more than 50% of the

voting interests of the flow-through entity, and the parties have business activities that satisfy either a flow of value test or a business integration test.

Federal Employer Identification Number (FEIN)

Taxpayer Name (If Unitary Business Group, Name of Designated Member)

Federal Employer Identification Number (FEIN)

Unitary Business Groups Only: Name of the Unitary Business Group Member Reporting on This Form

IMPORTANT: If any of the flow-through entities (FTE) listed below files a Michigan Business Tax (MBT) return for its tax year that ends with or within the tax

year of the CIT taxpayer named above, leave Column E blank for that FTE.

A.

B.

C.

D.

E.

Distributive Share

Flow-Through Entity

Apportioned Distributive

of Flow-Through Entity

Apportionment

Share of Flow-Through

Flow-Through Entity Name

FEIN

Income

Percentage

Entity Income

If more space is needed, include additional copies of Form 4898. Repeat the taxpayer name and FEIN at the top of every copy.

+

0000 2014 26 01 27 7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4