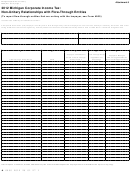

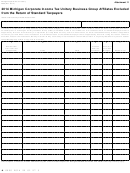

Form 4898 - Michigan Corporate Income Tax: Non-Unitary Relationships With Flow-Through Entities - 2014 Page 4

ADVERTISEMENT

Tiered Entities: In the event of a tiered entity, enter in this

column the distributive share received from a non-unitary FTE

in which the taxpayer has an indirect ownership interest. When

computing the distributive share of income received from the

non-unitary FTE in which the taxpayer has a direct ownership

interest, only enter the direct income of that FTE. This is done

by subtracting any distributive shares of income that this FTE

received from another FTE.

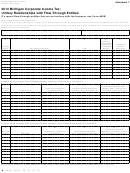

Example: C-corporation 1 owns 50% of FTE B (FTE B)

and FTE B owns 40% of FTE A (FTE A). FTE B received

from FTE A a distributive share of income of $20,000. C

Corporation 1 received from FTE B a distributive share of

income of $100,000. On the line corresponding to FTE A,

C Corporation 1 would enter $10,000. This is the indirect

distributive share that C Corporation 1 received from FTE A

and is calculated by multiplying C Corporation 1’s ownership

interest in FTE B by the distributive share FTE B received

from FTE A:

50% x $20,000 = $10,000

On the line corresponding to FTE B, C Corporation 1 would

enter $90,000. This is the distributive share C Corporation 1

received from FTE B less the distributive share C Corporation

1 received from FTE A:

$100,000 - $10,000 = $90,000

NOTE: The sum of the amount in every line on column C

(plus, in the case of a UBG, the sum of column C for all other

UBG members that filed this form) should equal the amount

reported on Form 4891, line 27.

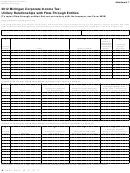

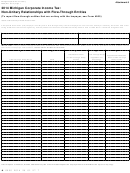

Column D: Enter in this column the non-unitary FTE’s

apportionment percentage. Enter this amount as a percentage.

The non-unitary FTE’s apportionment percentage is the FTE’s

sales factor.

The sales factor is a fraction, the numerator

of which is the total sales of the FTE in this state during the

tax year and the denominator of which is the total sales of the

FTE everywhere during the tax year. For more information

on what is a sale, see the instructions for Form 4891. Use the

information in the “Sourcing of Sales to Michigan” section of

Form 4890 to determine Michigan sales. Enter this amount as

a percentage, carrying it out 4 digits to the right of the decimal

point (i.e. 12.3456). Do not enter a percent symbol (%).

Column E: Enter the non-unitary flow-through distributive

income after apportionment by multiplying the amount in

column C by the apportionment percentage in column D for

every FTE included on this form.

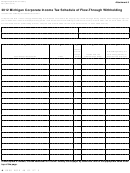

RECENT STATUTORY CHANGE: Under PA 233 of 2013,

if any of the flow-through entities (FTE) listed on this form

files a Michigan Business Tax (MBT) return for its tax year

that ends with or within the tax year of the CIT taxpayer named

above, leave Column E blank for that FTE.

NOTE: The sum of the amount in every line on column E (in

the case of a UBG, the sum of column E for all UBG members

that filed this form) should equal the amount reported on Form

4891, line 35.

Include completed Form 4898 as part of the tax return filing.

62

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4