Form Eft-1 - Authorization Agreement For Electronic Funds Transfer

ADVERTISEMENT

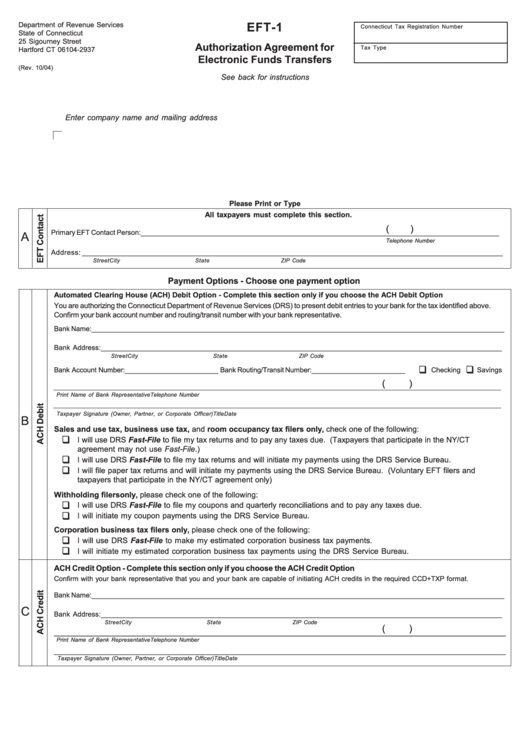

EFT-1

Department of Revenue Services

Connecticut Tax Registration Number

State of Connecticut

25 Sigourney Street

Authorization Agreement for

Tax Type

Hartford CT 06104-2937

Electronic Funds Transfers

(Rev. 10/04)

See back for instructions

Enter company name and mailing address

Please Print or Type

All taxpayers must complete this section.

(

)

Primary EFT Contact Person: ____________________________________________________________________________________________

A

Telephone Number

Address: ____________________________________________________________________________________________________________

Street

City

State

ZIP Code

Payment Options - Choose one payment option

Automated Clearing House (ACH) Debit Option - Complete this section only if you choose the ACH Debit Option

You are authorizing the Connecticut Department of Revenue Services (DRS) to present debit entries to your bank for the tax identified above.

Confirm your bank account number and routing/transit number with your bank representative.

Bank Name: __________________________________________________________________________________________________________

Bank Address: _______________________________________________________________________________________________________

Street

City

State

ZIP Code

Bank Account Number: ________________________ Bank Routing/Transit Number: ________________________

Checking

Savings

(

)

Print Name of Bank Representative

Telephone Number

Taxpayer Signature (Owner, Partner, or Corporate Officer)

Title

Date

B

Sales and use tax, business use tax, and room occupancy tax filers only, check one of the following:

I will use DRS Fast-File to file my tax returns and to pay any taxes due. (Taxpayers that participate in the NY/CT

agreement may not use Fast-File.)

I will use DRS Fast-File to file my tax returns and will initiate my payments using the DRS Service Bureau.

I will file paper tax returns and will initiate my payments using the DRS Service Bureau. (Voluntary EFT filers and

taxpayers that participate in the NY/CT agreement only)

Withholding filers only, please check one of the following:

I will use DRS Fast-File to file my coupons and quarterly reconciliations and to pay any taxes due.

I will initiate my coupon payments using the DRS Service Bureau.

Corporation business tax filers only, please check one of the following:

I will use DRS Fast-File to make my estimated corporation business tax payments.

I will initiate my estimated corporation business tax payments using the DRS Service Bureau.

ACH Credit Option - Complete this section only if you choose the ACH Credit Option

Confirm with your bank representative that you and your bank are capable of initiating ACH credits in the required CCD+TXP format.

Bank Name: __________________________________________________________________________________________________________

C

Bank Address: _______________________________________________________________________________________________________

Street

City

State

ZIP Code

(

)

____________________________________________________________________________________________________________________

Print Name of Bank Representative

Telephone Number

____________________________________________________________________________________________________________________

Taxpayer Signature (Owner, Partner, or Corporate Officer)

Title

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1