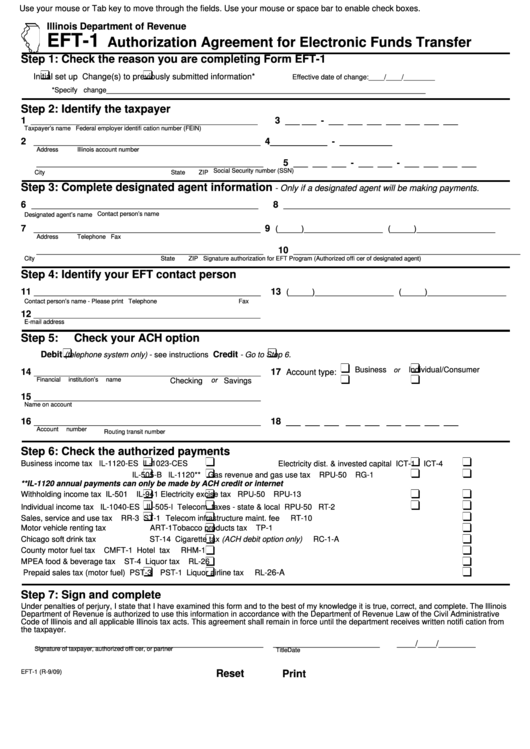

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

EFT-1

Authorization Agreement for Electronic Funds Transfer

Step 1: Check the reason you are completing Form EFT-1

Initial set up

Change(s) to previously submitted information*

Effective date of change:____/____/________

_____________________________________________________________________

*Specify change

Step 2: Identify the taxpayer

1

3 ___ ___ - ___ ___ ___ ___ ___ ___ ___

_________________________________________________

Taxpayer’s name

Federal employer identifi cation number (FEIN)

2

4 ____________ - ___________

_________________________________________________

Address

Illinois account number

5 ___ ___ ___ - ___ ___ - ___ ___ ___ ___

_________________________________________________

Social Security number (SSN)

City

State

ZIP

Step 3: Complete designated agent information

- Only if a designated agent will be making payments.

6

8

_________________________________________________

_________________________________________________

Contact person’s name

Designated agent’s name

7

9

_________________________________________________

(_____)_________________

(_____)_________________

Address

Telephone

Fax

10

_________________________________________________

_________________________________________________

City

State

ZIP

Signature authorization for EFT Program (Authorized offi cer of designated agent)

Step 4: Identify your EFT contact person

11

13

_________________________________________________

(_____)_________________

(_____)_________________

Contact person’s name - Please print

Telephone

Fax

12

_________________________________________________

E-mail address

Step 5:

Check your ACH option

Debit

Credit

(telephone system only) - see instructions

- Go to Step 6.

Business

Individual/Consumer

or

14

17

_________________________________________________

Account type:

Financial institution’s name

Checking

or

Savings

15

_________________________________________________

Name on account

16

18 ___ ___ ___ ___ ___ ___ ___ ___ ___

_________________________________________________

Account number

Routing transit number

Step 6: Check the authorized payments

Business income tax

IL-1120-ES

IL-1023-CES

Electricity dist. & invested capital

ICT-1

ICT-4

IL-505-B

IL-1120**

Gas revenue and gas use tax

RPU-50

RG-1

**IL-1120 annual payments can only be made by ACH credit or internet

Withholding income tax

IL-501

IL-941

Electricity excise tax

RPU-50

RPU-13

Individual income tax

IL-1040-ES

IL-505-I

Telecom taxes - state & local

RPU-50

RT-2

Sales, service and use tax

RR-3

ST-1

Telecom infrastructure maint. fee

RT-10

Motor vehicle renting tax

ART-1

Tobacco products tax

TP-1

Chicago soft drink tax

ST-14

Cigarette tax (ACH debit option only)

RC-1-A

County motor fuel tax

CMFT-1

Hotel tax

RHM-1

MPEA food & beverage tax

ST-4

Liquor tax

RL-26

26-A

Prepaid sales tax (motor fuel)

PST-3

PST-1

Liquor airline tax

RL-

Step 7: Sign and complete

Under penalties of perjury, I state that I have examined this form and to the best of my knowledge it is true, correct, and complete. The Illinois

Department of Revenue is authorized to use this information in accordance with the Department of Revenue Law of the Civil Administrative

Code of Illinois and all applicable Illinois tax acts. This agreement shall remain in force until the department receives written notifi cation from

the taxpayer.

_________________________________________________

_______________________

____/____/________

Signature of taxpayer, authorized offi cer, or partner

Title

Date

EFT-1 (R-9/09)

Reset

Print

1

1