Form 4894 - Corporate Income Tax Schedule Of Shareholders And Officers - 2014 Page 2

ADVERTISEMENT

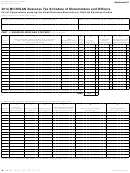

4894, Page 2

FEIN

UBG Member FEIN

PART 2: ShAREhOLDERS AND OFFICERS — Continued

3. h

I

J

k

L

M

N

Dividends

Total compensation and director

fees for officers and/or share-

Total shareholder/officer

Member

(used to determine

Salaries, wages

Employee insurance

Number

active shareholders)

and director fees

plans, pensions, etc.

holders. Add columns J and K.

Share of business income/loss

income. Add columns L and M.

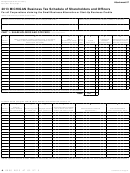

If more space is needed to complete Part 2, include additional copies of Form 4894. Repeat the taxpayer name and FEIN at the top of every copy of

page 1, and carry over the FEIN to the top of page 2. (See instructions.)

IMPORTANT NOTE ON COMPLETING THIS FORM: If a shareholder owned stock for less than the entire tax year of the corporation, or an officer

served as an officer for less than the entire tax year, or the tax year is less than 12 months, report only the salaries, wages, and director fees

earned while serving as an officer or shareholder during the tax year. These amounts must be annualized when determining Small Business

Alternative Credit disqualifiers, but should be reported as actual amounts on this form.

+

0000 2014 18 02 27 2

Continue on Page 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7