Form 4894 - Corporate Income Tax Schedule Of Shareholders And Officers - 2014 Page 7

ADVERTISEMENT

EXAMPLE: In this case, the husband and daughter are active

For Tax Years Less Than 12 Months: Shareholder compensation

must be annualized when determining disqualifiers, but should be

shareholders because their total compensation, director fees, and

reported as actual amounts on this form.

dividends from the business are greater than $10,000. The wife

and son are not active because their total compensation, director

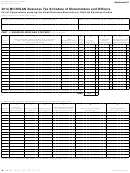

PART 3: LIST OF FAMILY MEMBERS AND ThEIR

fees, and dividends from the business are less than $10,000.

CORRESPONDING RELATIONShIP TYPE

Columns P through S represent relationships affected by

Stock Percentage

attribution.

Column E

Column F

Column G

Husband

100%

70%

For each shareholder listed in Part 2, column A, enter the

40%

(active)

(all shareholders)

(husband/wife/son)

corresponding number of the shareholder’s spouse, parent,

child, or grandchild, if any, listed in Part 2, column A.

Wife

100%

100%

10%

(inactive)

(all shareholders)

(all shareholders)

If more than one number is entered in boxes P through S,

Son

70% (husband/

70%

separate numbers with a dash. For example, if a family member

20%

(inactive)

wife/son)

(husband/wife/son)

has three children, each child’s member number should appear

in the “Child” column with dashes separating them (“2-3-4”).

Daughter

80% (husband/

40%

30%

(active)

wife/daughter)

(wife/daughter)

Do not use a dash to imply included numbers (such as “5-8”

meaning “5 through 8”), but instead include each member

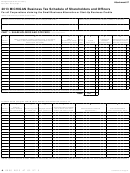

Column I: Enter total dividends received by each shareholder

number (“5-6-7-8”). Do not use commas.

during the tax year from this business (used to determine active

shareholders).

EXAMPLE (SEE THE ATTRIBUTION EXAMPLE ON

THE PREVIOUS PAGE): Kathy Rock’s (6) parents (4 and 5)

Column J: Enter salaries, wages, and director fees that

work for the company. Kathy will list “4-5” in column Q.

are attributable to each shareholder or corporate officer.

Compensation paid by a professional employer organization

NOTE: If the space provided in the line 4 columns is not

to the officers of a client (if the client is a corporation) and to

adequate to list all of the corresponding relationships, include a

employees of the professional employer organization who are

separate sheet of paper with the member number from column

assigned or leased to and perform services for a client must

O, the corresponding relationship, and the number of the

be included in determining the eligibility of the client for this

member(s) with that relationship.

credit.

Column T: Check column T for each shareholder listed only

NOTE: If a shareholder owned stock for less than the entire

if columns P through S are blank (no attributable relationship

tax year of the corporation, or an officer served as an officer

exists).

less than the entire tax year, report only the salaries, wages

Include completed Form 4894 as part of the tax return filing.

and director fees attributable while serving as an officer

or shareholder. These amounts must be annualized when

determining disqualifiers, but should be reported as actual

amounts on this form.

NOTE: All compensation must be included, whether or not the

shareholder or corporation officer worked in Michigan.

Column K: Enter employee insurance payments and pensions

that are attributable to each shareholder or C Corporation

officer.

NOTE: If a shareholder owned stock for less than the entire tax

year of the corporation, or an officer served as an officer less

than the entire tax year, report only the employee insurance

payments, pensions, etc., that are attributable while serving as

an officer or shareholder. These amounts must be annualized

when determining disqualifiers, but should be reported as

actual amounts on this form.

NOTE: All compensation must be included, whether or not the

shareholder or corporation officer worked in Michigan.

Column M: Multiply the percentage in column G by line 6 on

Form 4893.

UBGs: Multiply the percentage in column G by the sum of

lines 12, 26 and 29 from the CIT Data on UBG Members (Form

4897).

37

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7