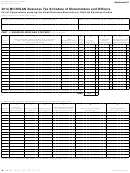

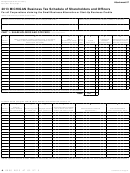

Form 4894 - Corporate Income Tax Schedule Of Shareholders And Officers - 2014 Page 5

ADVERTISEMENT

Instructions for Form 4894

Corporate Income Tax (CIT) Schedule of Shareholders and Officers

For all Corporations claiming the Small Business Alternative Credit

All attributable family members of those directly owning

Purpose

stock, who received compensation during the tax year, must be

To determine eligibility for all corporations to qualify for the

listed in Parts 2 and 3.

Small Business Alternative Credit (SBAC). This form must be

included when filing CIT Small Business Alternative Credit

Line-by-Line Instructions

(Form 4893).

Lines not listed are explained on the form.

Corporation means a taxpayer that is required or has elected to

Name and Account Number: Enter name and account number

file as a C Corporation under the Internal Revenue Code (IRC).

as reported on page 1 of the CIT Annual Return (Form 4891).

Corporation includes a Limited Liability Company that has

Also, the taxpayer Federal Employer Identification Number

elected to be taxed federally as a C Corporation.

(FEIN) from the top of page 1 must be repeated in the proper

location on pages 2 and 3.

Special Instructions for Unitary Business

Groups (UBGs)

Unitary Business Groups (UBGs): Complete one form for

each member that is a corporation. Enter the Designated

The allocated income disqualifier is based on all items paid

Member (DM) name in the Taxpayer Name field and the

or allocable to a shareholder or officer by all members of the

member to whom the schedule applies on the line below. On

UBG. All items paid or allocable to a single individual must be

the copy filed to report the DM’s data (if applicable), enter the

combined when calculating this disqualifier. This is a change

DM’s name and account number on each line. Also, the DM’s

from the comparable calculation in the Michigan Business Tax.

FEIN and the member’s FEIN from the top of page 1 must be

repeated in the proper location on pages 2 and 3.

General Instructions

PART 1: QUALIFYING DATA FOR ThE SMALL

If filing as a corporation (including Limited Liability

BUSINESS ALTERNATIVE CREDIT

Companies federally taxed as such) and claiming an SBAC,

NOTE: Parts 2 and 3 must be completed before Part 1.

complete this form and include it as part of the annual return

to report:

NOTE: If more than one 4894 is included for a filer, sum the

• Shareholder and corporation officer qualifications for the

totals for lines 1 and 2 on the top form.

SBAC;

Line 1: Add compensation and director fees in column L for

• Compensation and director fees of active shareholders and

each active shareholder and enter the result on line 1 and on

all officers for the computation of the SBAC.

Form 4893, line 7.

Officer means an officer of a corporation including all of the

An active shareholder:

following:

• Is a shareholder of the corporation, including through

(i) The chairperson of the board.

attribution, AND

• Owns at least 5 percent of outstanding stock, including

(ii) The president, vice president, secretary, or treasurer of

the corporation or board.

through attribution (column F = 5 percent or more), AND

• Receives at least $10,000 in compensation, director fees,

(iii) Persons performing similar duties and responsibilities

to persons described in subparagraphs (i) and (ii), that

and dividends from the business (sum of columns I and L

include, at a minimum, major decision making..

= $10,000 or more). Important: For short-period returns or

a part-year shareholder, compensation, director fees, and

Shareholder means a person who owns outstanding stock in

dividends of each individual must be annualized to meet this

a corporation or is a member of a business entity that files as

requirement.

a corporation for federal income tax purposes. An individual

is considered the owner of the stock, or the equity interest in

Annualizing

a business entity that files as a corporation for federal income

Multiply each applicable amount by 12 and divide the result

tax purposes owned, directly or indirectly, by or for family

by the number of months in the tax year or the number of

members as defined by IRC § 318(a)(1).

months the person was a shareholder. Generally, a tax year is

A family member, as defined by IRC § 318(a)(1), includes

considered to include the full month if the business operated

for more than half the days of the month.

spouses, parents, children and grandchildren.

NOTE: Annualization is only to determine eligibility for the

NOTE: Rules of attribution in IRC § 318(a)(1) do not

credit. Use actual amounts on this form.

differentiate between an adult and a minor child.

Outstanding stock means all stock of record, regardless of

Line 2: Add the compensation and director fees in column L

for each corporation officer who is not an active shareholder

class, value, or voting rights, but outstanding stock does not

and enter the result on line 2 and on Form 4893, line 8.

include treasury stock.

35

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7