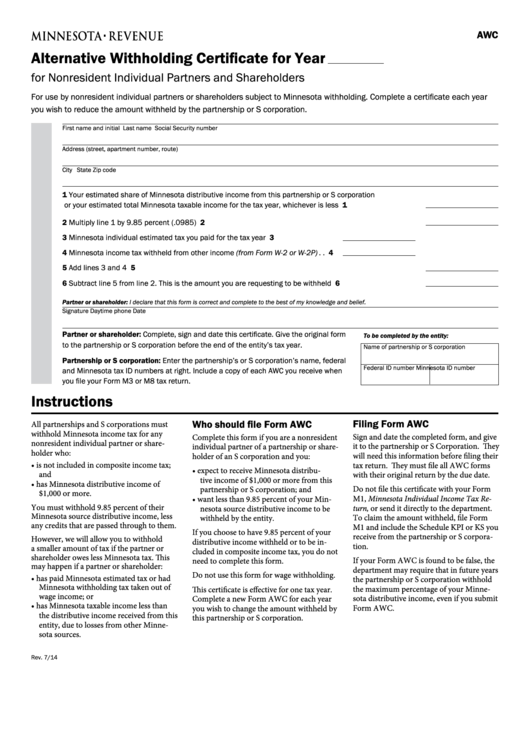

AWC

Alternative Withholding Certificate for Year

for Nonresident Individual Partners and Shareholders

For use by nonresident individual partners or shareholders subject to Minnesota withholding. Complete a certificate each year

you wish to reduce the amount withheld by the partnership or S corporation .

First name and initial

Last name

Social Security number

Address (street, apartment number, route)

City

State

Zip code

1 Your estimated share of Minnesota distributive income from this partnership or S corporation

or your estimated total Minnesota taxable income for the tax year, whichever is less . . . . . . . . . . . . . . . . . 1

2 Multiply line 1 by 9 .85 percent ( .0985) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Minnesota individual estimated tax you paid for the tax year . . . . . . . . . . . . . . . 3

4 Minnesota income tax withheld from other income (from Form W-2 or W-2P) . . 4

5 Add lines 3 and 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Subtract line 5 from line 2 . This is the amount you are requesting to be withheld . . . . . . . . . . . . . . . . . . . 6

Partner or shareholder: I declare that this form is correct and complete to the best of my knowledge and belief.

Signature

Daytime phone

Date

Partner or shareholder: Complete, sign and date this certificate. Give the original form

To be completed by the entity:

to the partnership or S corporation before the end of the entity’s tax year .

Name of partnership or S corporation

Partnership or S corporation: Enter the partnership’s or S corporation’s name, federal

Federal ID number

Minnesota ID number

and Minnesota tax ID numbers at right . Include a copy of each AWC you receive when

you file your Form M3 or M8 tax return.

Instructions

Filing Form AWC

Who should file Form AWC

All partnerships and S corporations must

withhold Minnesota income tax for any

Sign and date the completed form, and give

Complete this form if you are a nonresident

nonresident individual partner or share-

it to the partnership or S Corporation. They

individual partner of a partnership or share-

holder who:

will need this information before filing their

holder of an S corporation and you:

• is not included in composite income tax;

tax return. They must file all AWC forms

• expect to receive Minnesota distribu-

and

with their original return by the due date.

tive income of $1,000 or more from this

• has Minnesota distributive income of

Do not file this certificate with your Form

partnership or S corporation; and

$1,000 or more.

M1, Minnesota Individual Income Tax Re-

• want less than 9.85 percent of your Min-

You must withhold 9.85 percent of their

turn, or send it directly to the department.

nesota source distributive income to be

Minnesota source distributive income, less

To claim the amount withheld, file Form

withheld by the entity.

any credits that are passed through to them.

M1 and include the Schedule KPI or KS you

If you choose to have 9.85 percent of your

receive from the partnership or S corpora-

However, we will allow you to withhold

distributive income withheld or to be in-

tion.

a smaller amount of tax if the partner or

cluded in composite income tax, you do not

shareholder owes less Minnesota tax. This

If your Form AWC is found to be false, the

need to complete this form.

may happen if a partner or shareholder:

department may require that in future years

Do not use this form for wage withholding.

• has paid Minnesota estimated tax or had

the partnership or S corporation withhold

Minnesota withholding tax taken out of

the maximum percentage of your Minne-

This certificate is effective for one tax year.

wage income; or

sota distributive income, even if you submit

Complete a new Form AWC for each year

• has Minnesota taxable income less than

Form AWC.

you wish to change the amount withheld by

the distributive income received from this

this partnership or S corporation.

entity, due to losses from other Minne-

sota sources.

Rev . 7/14

1

1