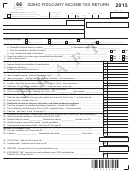

D-41 PAGE 2

*150410120002*

Name

FEIN

Tax and payments

.

$

00

13 Tax on fiduciary income.

13

.

$

00

14

14

Credit for taxes paid to other states

Credit may not exceed amount on Line 13. See

instructions, page 7. Attach copy of state return.

.

15

$

00

Net tax on fiduciary income

Line 13 minus Line 14.

15

.

16a

16a

$

00

Income tax withheld.

.

16b

16b

$

00

2015 estimated fiduciary income tax payments.

.

$

00

17

17

Payments made with extension of time to file

from FR-127F calculation, Line 3.

.

$

00

18

18

If this is an amended 2015 return, payments made with original 2015 D-41.

.

$

00

19

19

Total payments

Add Lines 16a–18.

If Line 19 is more than Line 15 subtract Line 15 from Line 19.

If Line 19 is less than Line 15 subtract Line 19 from Line 15.

23

Amount owed

.

20

Amount of

$

00

.

$

00

overpayment

Will this payment come from an account outside the U.S.?

Yes

No See instructions

21

Amount, if any, to be applied to 2016 estimated tax

.

$

00

Payment

Attach check or money order (US dollars) to the D-41P voucher only;

22

Refund

Subtract

.

make it payable to: DC Treasurer. Write the estate or trust’s FEIN

$

00

Line 21 from Line 20

and “2015 D-41” on your payment.

Will this refund you requested go to an account outside the U.S.?

Yes

No

See instructions

Refund Options:

Mark one refund choice:

Direct deposit

Paper check

Direct Deposit.

To have your refund deposited to your

checking OR

savings account, fill in oval and enter bank routing and account numbers. See instructions.

Routing Number

Account Number

Signature

Under penalties of law, I declare that I have examined this return and, to the best of my knowledge, it is correct.

Declaration of paid preparer is based on the information available to the preparer.

S

g i

a n

u t

e r

f o

d fi

c u

a i

y r

r o

f o

c fi

r e

e r

r p

s e

n e

i t

g n

t

e h

d fi

c u

a i

y r

D

a

e t

Signature of paid preparer

Preparer’s Tax Identification Number (PTIN)

P

e r

a p

e r

s ’ r

d a

d

e r

s s

n (

u

m

b

r e

n a

d

s

r t

e e

) t

C

y t i

S

a t

e t

Z

p i

C

o

e d

Send your signed and completed original return to:

Office of Tax and Revenue

PO Box 96153

Washington DC 20090-6153

2015 D-41 P2

Revised 03/15

Fiduciary Income Tax Return

1

1 2

2