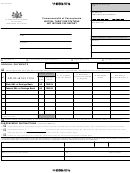

RCT-143

Revenue ID

PAGE 3 OF 4

(09-14)

Schedule A – Net Loss Carry Forward

(A)

(B)

(C)

(D)

(E)

Tax Year Beginning

Tax Year Ending

Net Loss Carry Forward to

Amount Deducted

Net Loss Carry Forward to

Current Period

Next Period

Total Column D

Schedule B – Interest Expense Allocable to Tax-Exempt Income

1. Total Tax-Exempt Income (from Page 2, Line 4)................................................................1.

2. Total Interest Income for Year ........................................................................................2.

3. Line 1 divided by Line 2 ................................................................................................3.

4. Total Interest Expense...................................................................................................4.

5. Interest Expense Allocable to Tax Exempt Income (Multiply Line 3 by Line 4,

Carry to Page 2, Line 5) ................................................................................................5.

Schedule C – Apportionment Summary

Calculation of Net Income Tax Apportionment

6. Payroll Inside PA (from Schedule D, Line 1a)....................................................................6.

7. Total Payroll (from Schedule D, Line 1b) ..........................................................................7.

8. Payroll Factor (Line 6 divided by Line 7) .........................................................................8.

9. Receipts Inside PA (from Schedule D, Line 11a)................................................................9.

10. Total Receipts (from Schedule D, Line 11b) ....................................................................10.

11. Receipts Factor (Line 9 divided by Line 10) ....................................................................11.

12. Average Deposits Inside PA (from Schedule D, Line 17a) .................................................12.

13. Average Total Deposits (from Schedule D, Line 17b)........................................................13.

14. Deposits Factor (Line 12 divided by Line 13) ..................................................................14.

15. Total of Proportions (Line 8 plus Line 11 plus Line 14) .....................................................15.

16. Apportionment Factor (See Instructions) ........................................................................16.

Reset Entire Form

RETURN TO PAGE 1

NEXT PAGE

PRINT FORM

1

1 2

2 3

3 4

4