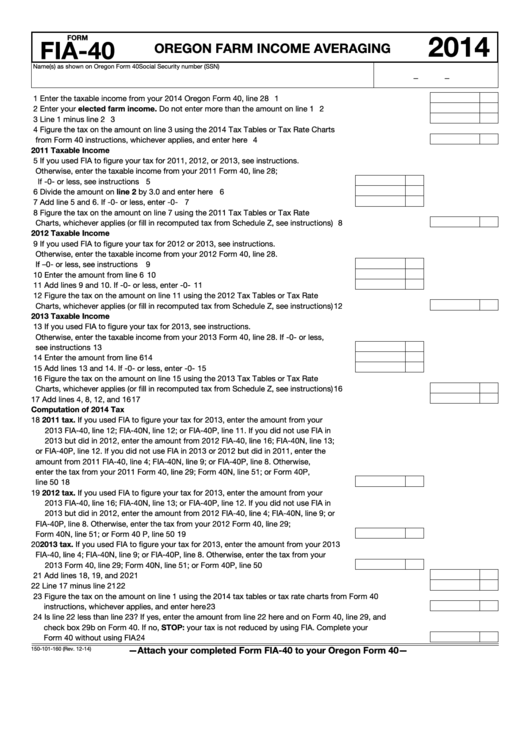

Clear This Page

2014

FORM

FIA-40

OREGON FARM INCOME AVERAGING

Name(s) as shown on Oregon Form 40

Social Security number (SSN)

—

—

1 Enter the taxable income from your 2014 Oregon Form 40, line 28 ................................................................. 1

2 Enter your elected farm income. Do not enter more than the amount on line 1 ............................................. 2

3 Line 1 minus line 2 ............................................................................................................................................. 3

4 Figure the tax on the amount on line 3 using the 2014 Tax Tables or Tax Rate Charts

from Form 40 instructions, whichever applies, and enter here ......................................................................... 4

2011 Taxable Income

5 If you used FIA to figure your tax for 2011, 2012, or 2013, see instructions.

Otherwise, enter the taxable income from your 2011 Form 40, line 28;

If -0- or less, see instructions ........................................................................................ 5

6 Divide the amount on line 2 by 3.0 and enter here ........................................................ 6

7 Add line 5 and 6. If -0- or less, enter -0- ........................................................................ 7

8 Figure the tax on the amount on line 7 using the 2011 Tax Tables or Tax Rate

Charts, whichever applies (or fill in recomputed tax from Schedule Z, see instructions) ................................... 8

2012 Taxable Income

9 If you used FIA to figure your tax for 2012 or 2013, see instructions.

Otherwise, enter the taxable income from your 2012 Form 40, line 28.

If –0- or less, see instructions .........................................................................................

9

10 Enter the amount from line 6 .......................................................................................... 10

11 Add lines 9 and 10. If -0- or less, enter -0- .................................................................... 11

12 Figure the tax on the amount on line 11 using the 2012 Tax Tables or Tax Rate

Charts, whichever applies (or fill in recomputed tax from Schedule Z, see instructions) ................................... 12

2013 Taxable Income

13 If you used FIA to figure your tax for 2013, see instructions.

Otherwise, enter the taxable income from your 2013 Form 40, line 28. If -0- or less,

see instructions .............................................................................................................. 13

14 Enter the amount from line 6 .......................................................................................... 14

15 Add lines 13 and 14. If -0- or less, enter -0- .................................................................. 15

16 Figure the tax on the amount on line 15 using the 2013 Tax Tables or Tax Rate

Charts, whichever applies (or fill in recomputed tax from Schedule Z, see instructions) ................................... 16

17 Add lines 4, 8, 12, and 16 ................................................................................................................................... 17

Computation of 2014 Tax

18 2011 tax. If you used FIA to figure your tax for 2013, enter the amount from your

2013 FIA-40, line 12; FIA-40N, line 12; or FIA-40P, line 11. If you did not use FIA in

2013 but did in 2012, enter the amount from 2012 FIA-40, line 16; FIA-40N, line 13;

or FIA-40P, line 12. If you did not use FIA in 2013 or 2012 but did in 2011, enter the

amount from 2011 FIA-40, line 4; FIA-40N, line 9; or FIA-40P, line 8. Otherwise,

enter the tax from your 2011 Form 40, line 29; Form 40N, line 51; or Form 40P,

line 50 ............................................................................................................................. 18

19 2012 tax. If you used FIA to figure your tax for 2013, enter the amount from your

2013 FIA-40, line 16; FIA-40N, line 13; or FIA-40P, line 12. If you did not use FIA in

2013 but did in 2012, enter the amount from 2012 FIA-40, line 4; FIA-40N, line 9; or

FIA-40P, line 8. Otherwise, enter the tax from your 2012 Form 40, line 29;

Form 40N, line 51; or Form 40 P, line 50 ........................................................................ 19

20 2013 tax. If you used FIA to figure your tax for 2013, enter the amount from your 2013

FIA-40, line 4; FIA-40N, line 9; or FIA-40P, line 8. Otherwise, enter the tax from your

2013 Form 40, line 29; Form 40N, line 51; or Form 40P, line 50 ..................................... 20

21 Add lines 18, 19, and 20 ..................................................................................................................................... 21

22 Line 17 minus line 21 .......................................................................................................................................... 22

23 Figure the tax on the amount on line 1 using the 2014 tax tables or tax rate charts from Form 40

instructions, whichever applies, and enter here ................................................................................................. 23

24 Is line 22 less than line 23? If yes, enter the amount from line 22 here and on Form 40, line 29, and

check box 29b on Form 40. If no, STOP: your tax is not reduced by using FIA. Complete your

Form 40 without using FIA .................................................................................................................................. 24

—Attach your completed Form FIA-40 to your Oregon Form 40—

150-101-160 (Rev. 12-14)

1

1 2

2 3

3 4

4 5

5