114415

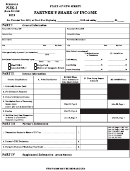

PART B - Income Allocation for Nonresidents and Part-Year Residents

Income

Total from federal return:

Amount from Kansas sources:

00

00

B1

B1

B1. Wages, salaries, tips, etc. ...............................

00

00

Shade box

B2

B2

B2. Interest and dividend income ...........................

for negative

00

00

B3

amounts.

B3

B3. Refund of state & local income taxes ...............

Example:

00

00

B4

B4

B4. Alimony received ..............................................

00

00

B5

B5

B5. Business income or loss .........................

00

00

B6

B6

B6. Farm income or loss ...............................

00

00

B7

B7

B7. Capital gain or loss .................................

00

00

B8

B8

B8. Other gains or losses ..............................

00

00

B9

B9

B9. Pensions, IRA distributions & annuities ............

B10. Rental real estate, estates, trusts,

00

00

B10

B10

royalties, partnerships, S corps, etc. .........

00

B11. Unemployment compensation, taxable

00

B11

B11

social security benefits & other income ...

00

B12

B12. Total income from Kansas sources (add lines B1 through B11) ...........................................

Adjustments

Total from federal return:

Amount from Kansas sources:

to Income

00

B13

00

B13

B13. IRA retirement deductions ...............................

00

00

B14

B14

B14. Penalty on early withdrawal of savings ............

Shade box

00

for negative

00

B15

B15

B15. Alimony paid ....................................................

amounts.

00

00

Example:

B16

B16. Moving expenses ............................................

B16

00

00

B17

B17

B17. Other federal adjustments ...............................

00

B18

B18. Total federal adjustments to Kansas source income (add lines B13 through B17) .........................

00

B19

B19. Kansas source income after federal adjustments (subtract line B18 from line B12 ) ............

00

B20

B20. Net modifications from Part A that are applicable to Kansas source income ........................

00

B21

B21. Modified Kansas source income (line B19 plus or minus line B20) ......................................

00

B22

B22. Kansas adjusted gross income (from line 3, Form K-40) ......................................................

Nonresident

B23. Nonresident allocation percentage (divide line B21 by line B22 and round to the fourth

Allocation

B23

decimal place, not to exceed 100.0000). Enter result here and on line 9 of Form K-40 ..............

Percentage

PART C - Kansas Itemized Deductions

Itemized

Deduction

00

C1

C1. Real estate taxes from line 6 of federal Schedule A $___________. Enter 50% of this amount ....

Computation

00

C2

C2. Personal property taxes from line 7 of federal Schedule A $__________. Enter 50% of this amount

00

C3. Qualified residence interest and mortgage insurance premiums you paid and reported on federal

CAUTION: Federal

C3

Schedule A line

Schedule A (see instructions) $___________. Enter 50% of this amount .................................

00

C4

numbers are from

C4. Gifts to charity from line 19 of federal Schedule A ...........................................................................

the 2014 form and

00

C5

are subject to

C5. Kansas itemized deductions (add lines C1 through C4). Enter result here and line 4 of Form K-40.

change for tax year

2015.

1

1 2

2