Instructions for FTB 914 – Filing Requirements

When to Use this Form

6.

Enter the form number of the state tax return or

other form that relates to this request. For example,

Use this form if you:

a California resident with an individual income tax

•

Experience a problem with Franchise Tax Board (FTB)

issue would enter Form 540.

that causes unwarranted financial difficulties for you,

7.

Enter the tax period that relates to this request.

your family, or your business.

8.

Enter the name of the individual we should contact.

•

Face (or your business faces) an immediate threat of

For partnerships, corporations, trusts, etc., enter

adverse action.

the name of the individual authorized to act on

•

Tried repeatedly to contact FTB, but no one

the entity’s behalf. If the contact person is not the

responded, or FTB has not responded by the date

taxpayer or other authorized individual, see the

promised.

instructions for Section 2.

9a.

Enter your daytime telephone number, including

If FTB staff will not help you or will not help you in time

the area code. If this is a cell phone number, mark

to avoid harm, you may submit this form. Executive

the box.

and Advocate Services (EAS) is the Taxpayers’ Rights

9b.

If you have an answering machine or voice mail at

Advocate’s designee to coordinate resolution of taxpayer

this number and you consent to EAS or other FTB

complaints and problems, including complaints about

staff leaving confidential information about your

unsatisfactory treatment by FTB staff. If your problem

tax issue at this number, mark the box. You are not

is not immediate or if you have been unable to contact

obligated to have information about your tax issue

the appropriate area, EAS staff may refer you to the

left at this number. If other individuals have access

appropriate area of the department and facilitate that

to the answering machine or the voice mail and

contact. If EAS accepts your case, we may stop certain

you do not wish for them to receive any confidential

activities while your request for assistance is pending (for

information about your tax issue, do not mark

example: wage garnishments, bank levies, and lien filings).

the box.

EAS or other FTB staff may contact third parties as

10.

Indicate the best time to call you. Specify a.m. or

necessary to respond to your request, and you may not

p.m. hours.

receive further notice about these contacts. For more

11.

Indicate any special communication needs you

information, see R&TC Section 19504.7.

require (such as sign language). Specify any

The Taxpayers’ Rights Advocate will not consider frivolous

language other than English.

arguments raised on this form. For more information

12a.

Describe the tax issue you are experiencing and

about frivolous arguments, go to ftb.ca.gov and search

any difficulties it may be creating. Specify the

for frivolous. If you use this form to submit a specified

actions that FTB has taken (or not taken) to resolve

frivolous transmission, you may be subject to a penalty of

the issue. If the issue involves an FTB delay of

$5,000 (R&TC Section 19179).

more than 30 days in resolving your issue, indicate

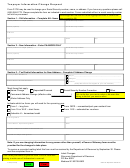

Section 1 Instructions

the date you first contacted FTB for assistance in

resolving your issue.

1a.

Enter your name or business entity name as

12b.

Describe the relief/assistance you request. Specify

shown on the tax return that relates to this request

the action that you want taken and that you

for assistance.

believe necessary to resolve the issue. Furnish any

1b.

Enter your taxpayer identifying number. If you are

documentation or substantiation that you believe

an individual, this number is either a social security

would assist us in resolving the issue.

number (SSN) or FTB identification number

13-14. If this is a joint assistance request, both

(FTBID). If you are a business entity, this number

spouses/RDPs must sign the appropriate lines

is your corporation number, partnership number,

and enter the date the request was signed. If only

federal employer identification number (FEIN), etc.

one spouse/RDP requests assistance, only the

2a.

Enter your spouse’s/RDP’s name (if applicable) if

requesting spouse/RDP must sign the request.

this request relates to a jointly filed return.

If you submit this request for another individual,

2b.

Enter your spouse’s/RDP’s taxpayer identifying

only a person authorized and empowered to act

number (SSN or FTBID) if this request relates to a

on that individual’s behalf should sign the request.

jointly filed return.

Requests for corporations must be signed by an

3a-d. Enter your current mailing address or business

officer and include the officer’s title.

entity mailing address, including street number and

Signing this request allows FTB by law to suspend

name, city, state, or foreign country, and ZIP code.

any applicable statutory periods of limitation

4.

Enter your fax number, including the area code.

(R&TC Section 21004). However, it does not suspend

5.

Enter your email address. We will only use this

any applicable periods for you to perform acts related to

information to contact you if we are unable to reach

assessment, collection, or requesting a hearing.

you by telephone and your issue appears to be

time sensitive. We will not use your email address

to discuss the specifics of your case unless we

initiate a secure email.

FTB 914 (NEW 01-2015) PAGE 2

1

1 2

2 3

3