Retraining means an upgrade in training for existing employees,

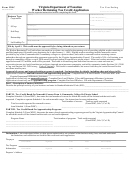

WHEN AND WHERE TO FILE FORM WRC

which is identified as essential to the production or distribution of

File Form WRC no later than April 1 in order for the qualification

a product, rendering services or retraining provided through an

process to be completed. Forms received after that date may not

apprenticeship agreement approved by the Virginia Apprenticeship

be processed and credit may not be approved.

Council.

If applying for the Worker Retraining Tax Credit based on the

Standard Fringe Benefits means the benefits that a particular

noncredit course alone or on both the noncredit course and

employer offers to its full-time employees.

an apprenticeship program, file Form WRC with all required

STEM or STEAM discipline means a science, technology,

attachments (listed below) to:

engineering, mathematics, or applied mathematics related

Worker Retraining Tax Credit Application

discipline as determined by the VEDP in consultation with the

Virginia Jobs Investment Program

Superintendent of Public Instruction. The term also includes a

Virginia Economic Development Partnership

health-care related discipline.

901 East Byrd Street

Training Costs means instruction, instructional materials, facilities

Richmond, VA 23219

fees and other costs determined to be necessary to the delivery

If applying for the Worker Retraining Tax Credit based only on

of the training. Trainee wages and curriculum development costs

the apprenticeship program, file Form WRC with all required

are not covered.

attachments (listed below) to:

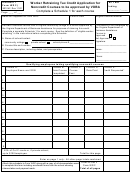

INSTRUCTIONS FOR COMPLETING FORM WRC

Tax Credit Unit

When completing Form WRC, remember that claiming the credit

Virginia Department of Taxation

is a multi-step process. Complete Form WRC and the required

P. O. Box 715

schedules using the definitions listed earlier in these instructions. To

Richmond, Virginia 23218-0715

assist you in completing Schedules 1 and 2 correctly, review these

WHAT TO ATTACH TO FORM WRC

definitions: Eligible worker retraining, qualified employee, noncredit

If Schedule 1 of Form WRC was completed, attach a copy of the

courses, retraining, standard fringe benefits and training costs.

documentation used in completing Schedule 1, including enrollment

Part I - Description of Business Activities

forms from the school/college showing the courses taken and

Enter the principal activity of the business.

payment by the employer.

If Schedule 2 of Form WRC was completed, attach a signed copy of

Part II - Credit Based on Noncredit Courses From a Community

the Apprenticeship Action Form, Apprenticeship Related Instruction

College or Private School

Enrollment Form, and proof of payment by employer.

Credit will be granted for retraining through noncredit courses

approved by the VEDP.

PASS-THROUGH ENTITIES

Complete Schedule 1 (Form WRC). If additional space is needed,

The Virginia Department of Taxation will issue a credit certification

attach a separate page. Complete a separate Schedule 1 for each

letter specifying the amount of credit authorized to each partnership,

course for which the credits are requested. Enter the total number

S-corporation or limited liability company qualifying to claim a

of courses and total credit requested for training costs for approved

portion of this credit.

courses in the space provided in Part II of the Form WRC.

Each pass-through entity must File Form PTE with the Department

of Taxation within 30 days after the credit is granted. This

Part III - Credit Based on Apprenticeship Programs

information should be sent to: Department of Taxation, ATTN:

Credit will be granted for apprenticeship programs (approved by

Tax Credit Unit, P.O. Box 715, Richmond, VA 23218-0715 or

the Virginia Apprenticeship Council through the Virginia Department

you may fax it to 804-786-2800.

of Labor and Industry) which meet the qualifications for this credit.

See the definitions provided earlier in these instructions, before

All pass-through entities distributing this credit to their owner(s),

shareholders, partners or members must give each a Schedule VK-

completing this section.

1, Owner’s Share of Income And Virginia Modifications And Credits.

Complete Schedule 2 (Form WRC).

WHERE TO GET HELP

• If you have more than one school, then use a separate

Schedule 2 for each school.

Write to the Virginia Department of Taxation, Tax Credit

Unit, P.O. Box 715, Richmond, VA 23218-0715 or call

• Enter the student names in alphabetical order.

804-786-2992. To order forms, call 804-367-8031. Visit

• If including additional summary worksheets, submit one

for most Virginia tax forms and additional

worksheet for each school and complete all fields as listed on

tax information. Forms are also available from the office of your

Schedule 2 (list student names in alphabetical order, school

local Commissioner of the Revenue, Director of Finance or Director

name, course name, etc.).

of Tax Administration.

• Organize each school in a separate folder with Form WRC,

Tenemos servicios disponibles en Español.

Schedule 2, invoices, Labor Department Apprenticeship Form

Virginia Tax Bulletin 99-4, dated April 5, 1999, provides additional

and copies of E-checks or cancelled checks.

information on the Worker Retraining Tax Credit and how the

See the definitions listed in these instructions before completing

credit applies. To obtain this bulletin, see the Where To Get Help

Schedule 2 to ensure that the training costs and employees listed

section above.

qualify for the credit.

Page 5

1

1 2

2 3

3 4

4 5

5