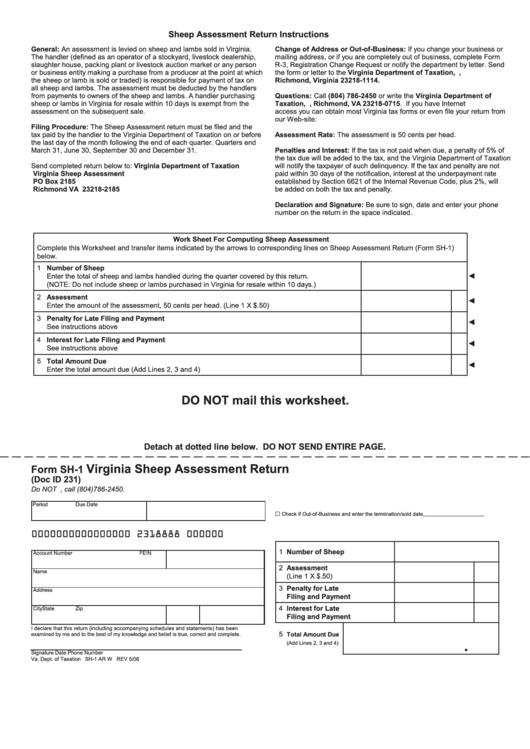

Sheep Assessment Return Instructions

General: An assessment is levied on sheep and lambs sold in Virginia.

Change of Address or Out-of-Business: If you change your business or

The handler (defined as an operator of a stockyard, livestock dealership,

mailing address, or if you are completely out of business, complete Form

slaughter house, packing plant or livestock auction market or any person

R-3, Registration Change Request or notify the department by letter. Send

or business entity making a purchase from a producer at the point at which

the form or letter to the Virginia Department of Taxation, P.O. Box 1114,

the sheep or lamb is sold or traded) is responsible for payment of tax on

Richmond, Virginia 23218-1114.

all sheep and lambs. The assessment must be deducted by the handlers

from payments to owners of the sheep and lambs. A handler purchasing

Questions: Call (804) 786-2450 or write the Virginia Department of

sheep or lambs in Virginia for resale within 10 days is exempt from the

Taxation, P.O. Box 715, Richmond, VA 23218-0715. If you have Internet

assessment on the subsequent sale.

access you can obtain most Virginia tax forms or even file your return from

our Web-site:

Filing Procedure: The Sheep Assessment return must be filed and the

Assessment Rate: The assessment is 50 cents per head.

tax paid by the handler to the Virginia Department of Taxation on or before

the last day of the month following the end of each quarter. Quarters end

March 31, June 30, September 30 and December 31.

Penalties and Interest: If the tax is not paid when due, a penalty of 5% of

the tax due will be added to the tax, and the Virginia Department of Taxation

Send completed return below to: Virginia Department of Taxation

will notify the taxpayer of such delinquency. If the tax and penalty are not

Virginia Sheep Assessment

paid within 30 days of the notification, interest at the underpayment rate

PO Box 2185

established by Section 6621 of the Internal Revenue Code, plus 2%, will

Richmond VA 23218-2185

be added on both the tax and penalty.

Declaration and Signature: Be sure to sign, date and enter your phone

number on the return in the space indicated.

Work Sheet For Computing Sheep Assessment

Complete this Worksheet and transfer items indicated by the arrows to corresponding lines on Sheep Assessment Return (Form SH-1)

below.

1 Number of Sheep

◄

Enter the total of sheep and lambs handled during the quarter covered by this return.

(NOTE: Do not include sheep or lambs purchased in Virginia for resale within 10 days.)

2 Assessment

◄

Enter the amount of the assessment, 50 cents per head. (Line 1 X $.50)

3 Penalty for Late Filing and Payment

◄

See instructions above

4 Interest for Late Filing and Payment

◄

See instructions above

5 Total Amount Due

◄

Enter the total amount due (Add Lines 2, 3 and 4)

DO NOT mail this worksheet.

Detach at dotted line below. DO NOT SEND ENTIRE PAGE.

Virginia Sheep Assessment Return

Form SH-1

(Doc ID 231)

Do NOT staple.

For assistance, call (804)786-2450.

Period

Due Date

□

Check if Out-of-Business and enter the termination/sold date

0000000000000000 2318888 000000

1 Number of Sheep

Account Number

FEIN

2 Assessment

Name

(Line 1 X $.50)

3 Penalty for Late

Address

Filing and Payment

4 Interest for Late

City

State

Zip

Filing and Payment

I declare that this return (including accompanying schedules and statements) has been

5

examined by me and to the best of my knowledge and belief is true, correct and complete.

Total Amount Due

(Add Lines 2, 3 and 4)

.

Signature

Date

Phone Number

Va. Dept. of Taxation SH-1 AR W REV 5/06

1

1