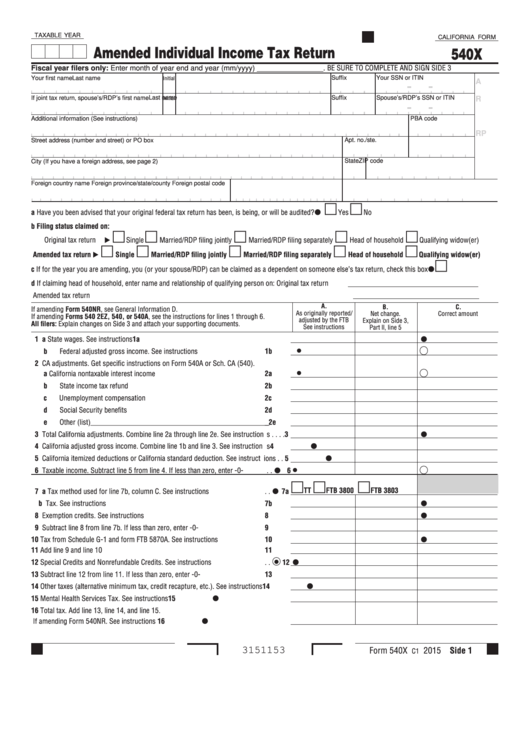

TAXABLE YEAR

CALIFORNIA FORM

Amended Individual Income Tax Return

540X

BE SURE TO COMPLETE AND SIGN SIDE 3

Fiscal year filers only: Enter month of year end and year (mm/yyyy) ________________.

Initial

Suffix

Your SSN or ITIN

Your first name

Last name

A

Initial

If joint tax return, spouse’s/RDP’s first name

Last name

Suffix

Spouse’s/RDP’s SSN or ITIN

R

PBA code

Additional information (See instructions)

RP

Apt. no./ste. no.

PMB/private mailbox

Street address (number and street) or PO box

State

ZIP code

City (If you have a foreign address, see page 2)

Foreign country name

Foreign province/state/county

Foreign postal code

a

Have you been advised that your original federal tax return has been, is being, or will be audited? . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

b

Filing status claimed on:

Original tax return

Single

Married/RDP filing jointly

Married/RDP filing separately

Head of household

Qualifying widow(er)

Amended tax return

Single

Married/RDP filing jointly

Married/RDP filing separately

Head of household

Qualifying widow(er)

c

If for the year you are amending, you (or your spouse/RDP) can be claimed as a dependent on someone else’s tax return, check this box . . . . . . . . . .

d

If claiming head of household, enter name and relationship of qualifying person on:

Original tax return

Amended tax return

A.

B.

C.

If amending Form 540NR, see General Information D .

As originally reported/

Net change .

Correct amount

If amending Forms 540 2EZ, 540, or 540A, see the instructions for lines 1 through 6 .

adjusted by the FTB

Explain on Side 3,

All filers: Explain changes on Side 3 and attach your supporting documents .

See instructions

Part ll, line 5

1 a State wages . See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1a

b Federal adjusted gross income . See instructions . . . . . . . . . . . . . . . . . . .

. . . . . 1b

2 CA adjustments . Get specific instructions on Form 540A or Sch . CA (540) .

a California nontaxable interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . 2a

b State income tax refund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . 2b

c Unemployment compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . 2c

d Social Security benefits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . 2d

e Other (list)_________________________________________________

_ . . . . 2e

3 Total California adjustments . Combine line 2a through line 2e . See instruction

s . . . . 3

4 California adjusted gross income . Combine line 1b and line 3 . See instruction

s . . . . 4

5 California itemized deductions or California standard deduction . See instruct

ions . . 5

6 Taxable income . Subtract line 5 from line 4 . If less than zero, enter -0- . . . . .

. .

6

TT

FTB 3800

FTB 3803

7 a Tax method used for line 7b, column C . See instructions . . . . . . . . . . . . .

. .

7a

b Tax . See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . 7b

8 Exemption credits . See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . 8

9 Subtract line 8 from line 7b . If less than zero, enter -0- . . . . . . . . . . . . . . . . .

. . . . . . 9

10 Tax from Schedule G-1 and form FTB 5870A . See instructions . . . . . . . . . . .

. . . . . 10

11 Add line 9 and line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . 11

12 Special Credits and Nonrefundable Credits . See instructions . . . . . . . . . . . . .

. .

12

13 Subtract line 12 from line 11 . If less than zero, enter -0- . . . . . . . . . . . . . . . .

. . . . . 13

14 Other taxes (alternative minimum tax, credit recapture, etc .) . See instructions . . . . 14

15 Mental Health Services Tax . See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

16 Total tax . Add line 13, line 14, and line 15 .

If amending Form 540NR . See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

Form 540X

2015 Side 1

3151153

C1

1

1 2

2 3

3